How to write an invoice: download your free invoice template

7-minute read

You’ve set up your business and sold goods or services to clients and customers, which means you need to send them an invoice to get paid. But how do you write an invoice?

Sending invoices can help you to get paid on time and avoid late payments, which is crucial if you want to maintain a healthy cash flow.

Even if you’ve been running your business for a while, you might be wondering whether there’s more information you should include when you draft your invoices.

Download your free invoice templates

This article explains how to make an invoice, but what about getting an invoice example you can use straight away?

Below you'll find a pack of four simple invoice templates that you can use to create your own professional invoices. Our template pack includes an editable blank invoice template PDF for limited companies and sole traders – both with and without VAT.

DownloadWhat is an invoice?

An invoice is a bill that businesses send to customers or clients, asking for payment for goods or services. Invoices usually include a description of the items you’re charging for along with payment terms, amongst other information.

Business invoicing is an important part of bookkeeping, as businesses need to keep information about sales and income for tax and accounting.

Invoices are different to receipts (which acknowledge payment) and purchase orders (which notify intent to buy goods and services).

If you want to give a customer a clear idea of what they’ve ordered and how much they’re going to need to pay you, you can provide them with a proforma invoice. This type of non-compulsory invoice is like a quote, in that it’s issued before the goods or services are delivered.

How to write an invoice: step-by-step

Wondering what to include on an invoice? The government says there’s certain information that your invoices must include – follow the steps below to get your invoices up and running in no time. And watch our video for more on how to invoice someone.

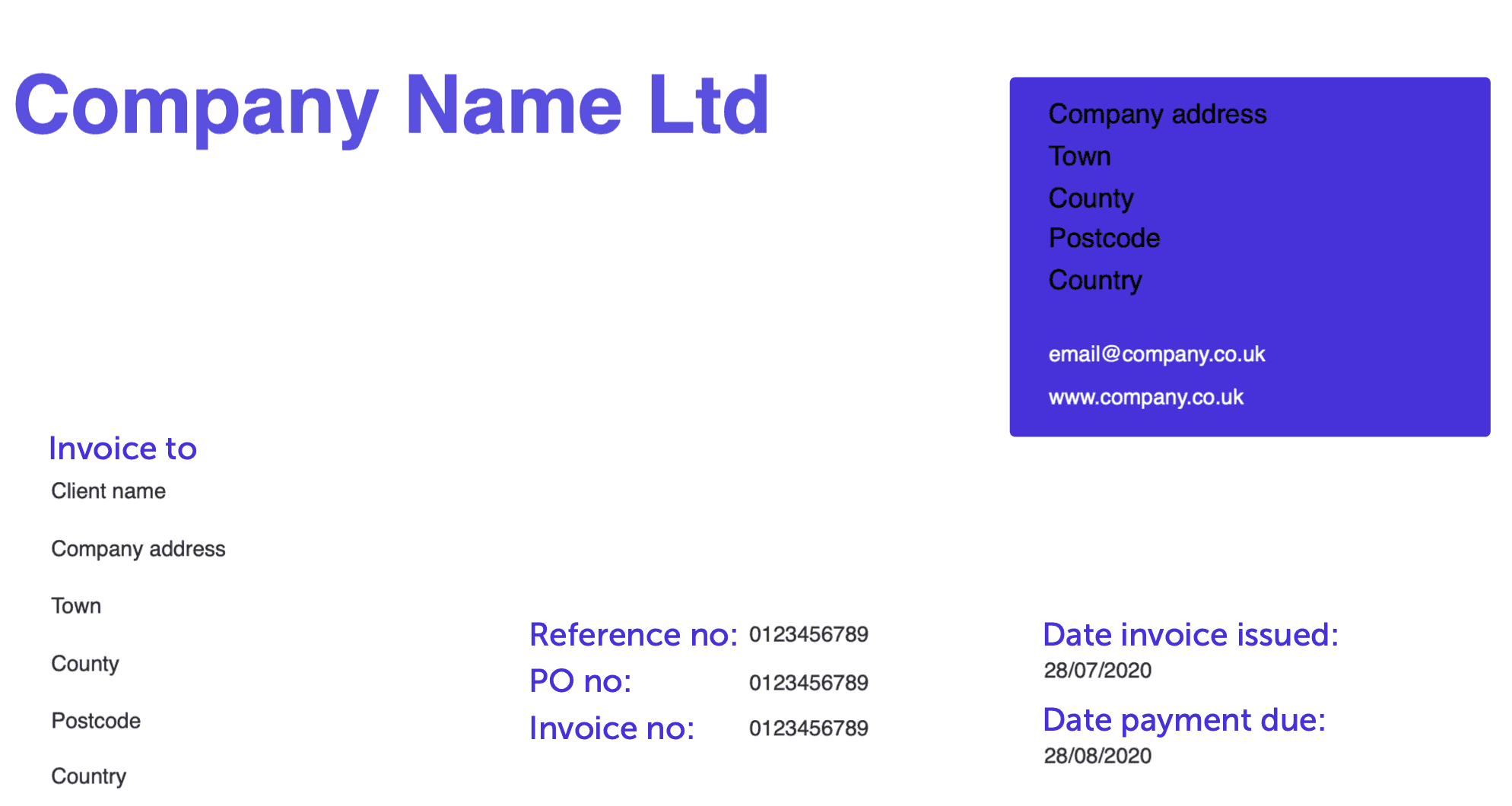

1. Make your self-employed invoice look professional

The first step is to put your invoice together. You can do this yourself using a word processor, Excel, or online design software such as Canva. You could also use one of our free self-employed invoice templates.

There may even be sample templates on your word processor, depending on the program you’re using.

You should use professional fonts and styling that match your brand, then add your logo and colours if possible.

2. Clearly mark your invoice

Make sure your customers know it’s an invoice they’re receiving. The guidelines on the government website state “you must clearly display the word ‘invoice’ on the document.”

Even adding the word ‘invoice’ at the top of your document might make it more likely you’ll be paid on time, as it makes your request for payment stand out from other documents your client might receive.

Your invoice needs to have a unique identification number. This is for your records, as you should have a reference for all the invoices you’ve raised to make sure you don’t create duplicates. Having a unique record of all your payments also helps you to keep track of your finances.

You can use a sequence of numbers that gradually increases. For example, your 2024 invoices could use a year, month, and number format. The first invoice you send in January would have the invoice number 202401001, while the 32nd invoice you send in March would have the invoice number 202403032.

You could also use letters in front of a number, which might indicate a specific client.

3. Add company name and information

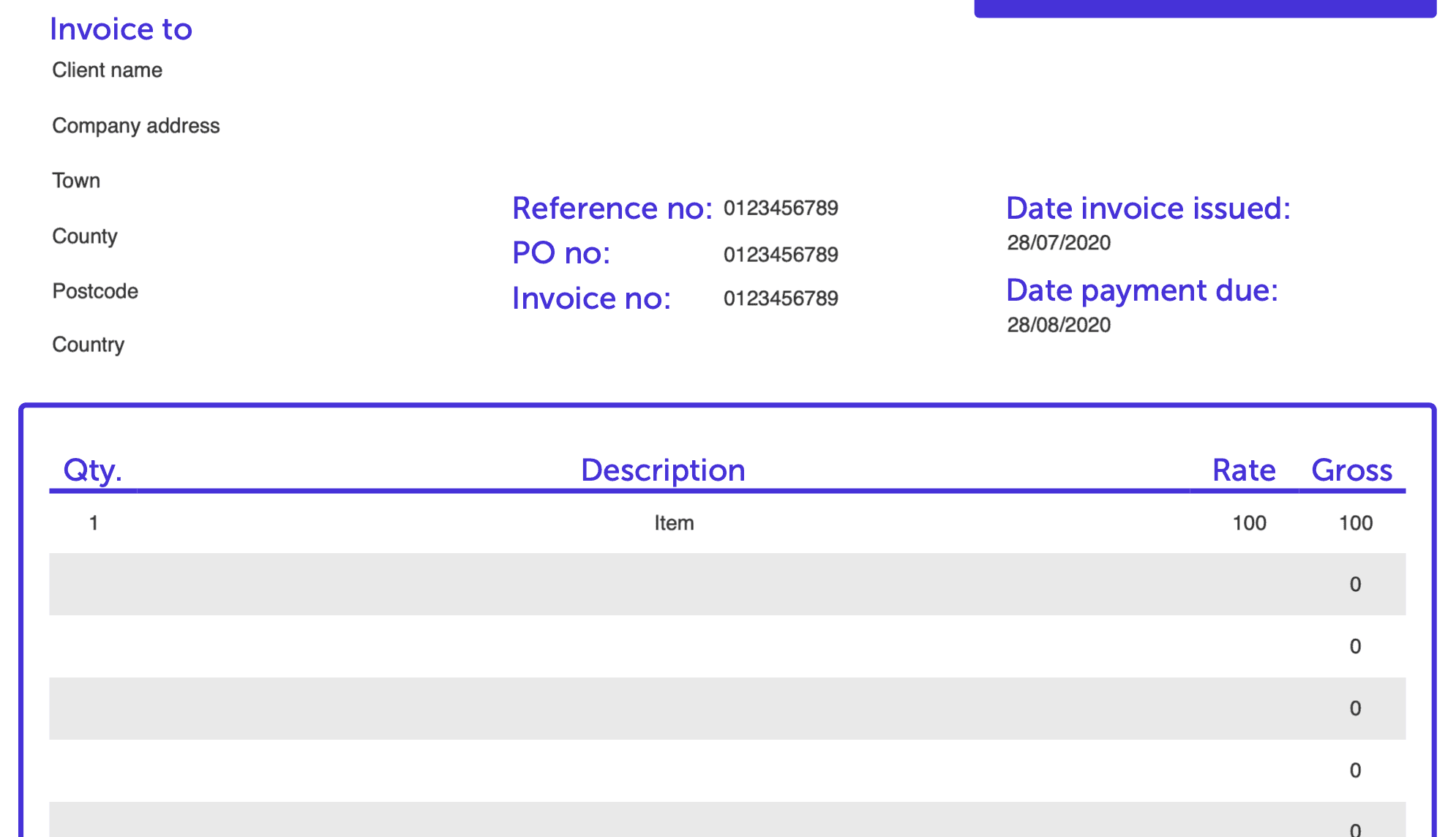

This means both your company’s information and the details of the company you’re invoicing. Here’s what you need to include:

- your company’s name, address, and contact details

- your customer’s company name and address, including a contact’s name so it reaches the right person

- your registered office address and company registration number if you’re a limited company, along with the formal registered name

Keep in mind that if you’re a limited company and you choose to add the names of your directors on the invoice, you need to add the names of all directors.

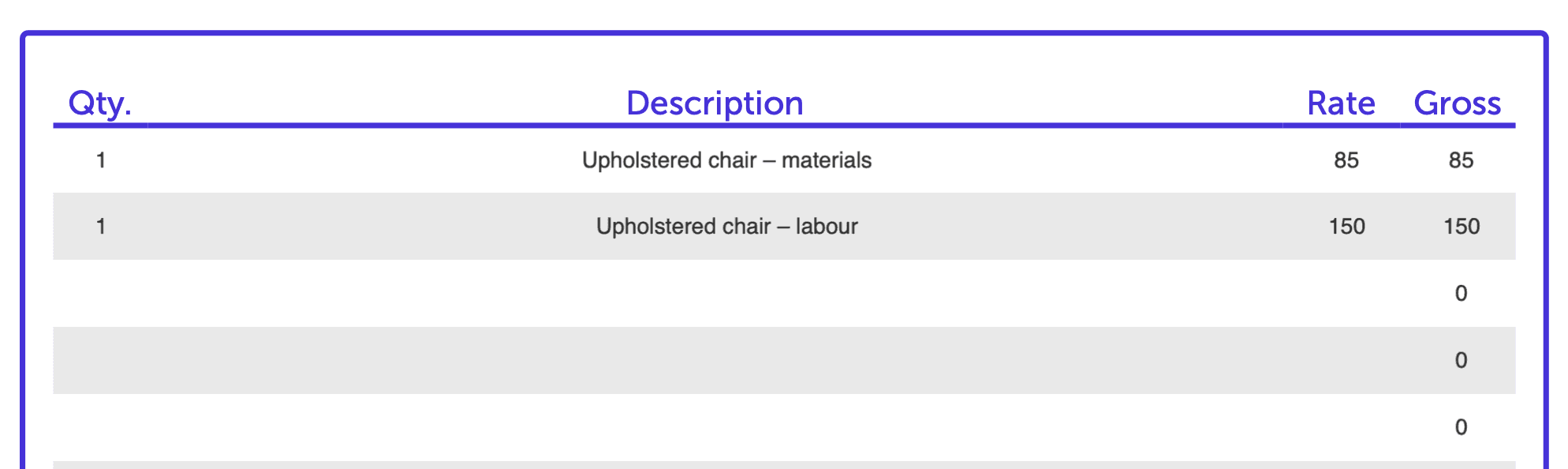

4. Write a description of the goods or services you’re charging for

These descriptions don’t need to be long, but they should be detailed enough for your customers to know what it is they’re paying for.

After all, if they have no idea what they’re being charged for, they’re more likely to query the invoice – leading to a delay in payment.

As an example, you run an upholstery business and a customer commissions you to refurbish an armchair. On the invoice, you could list the cost of the materials and labour separately so they know how much they’re paying for each.

Once you’ve added a clear description of each item, you should add in the quantity of each and the price.

5. Don’t forget the dates

You need to add some dates to your invoice. These are:

- the date you provided your goods or service (the supply date)

- the date you created the invoice

You could add the supply date to the description of your goods or service, and add the invoice date at the top along with your name, address, and contact details.

6. Add up the money owed

As well as including the costs of individual goods or services, you need to put the total amount owed as well.

Plus, if you’ve agreed a discount with your customer, note this down on the invoice and subtract it from the total cost.

If applicable, include the VAT amount too.

For example, you run a marketing agency and a customer buys four blogs for £300 and two social media posts for £150. You offered them a 10% discount on their total order of £450, which comes to £45. This leaves a subtotal of £405.

However, the customer must also pay 20% VAT of £81, leaving them with a total bill of £486. All of these costs will need to be included on the invoice you send them.

7. Mention payment terms

You should have agreed payment terms with the customer beforehand, but it’s a good idea to note the terms of payment on the invoice as well.

So if you expect to be paid within a certain number of days, remind the customer by including it on the invoice.

More importantly, note down how exactly your customer should make the payment. It’s likely you’ll want the customer to make the payment directly to a bank account. If that’s the case, be sure to add your bank details.

Unfortunately late payments have a negative impact on the cash flow of many small businesses. Our 2023 SME Insights Report found that late payments are a problem for 64 per cent of businesses, with more than a fifth (22 per cent) having been owed more than £25,000 in the past.

Encouraging quick payment by including clear payment terms – as well as making it easy for customers to pay you – should help to reduce late payments and improve your cash flow.

Issuing VAT invoices

The government states that you should use VAT invoices if you’re VAT registered. These invoices need more information on them than normal invoices.

There are three types of VAT invoices you can issue:

- A full invoice

- A modified invoice for retail supplies over £250

- A simplified invoice for supplies under £250

The information you need to include depends on the type of VAT invoice you’re issuing. Read more about guidelines for VAT invoices on the government website.

In general, though, they need the same information as normal invoices, plus:

- your VAT registration number

- the tax point (time of supply) if it’s different than the invoice date

- the VAT rate and total VAT charged, if all the items are charged at the same rate

- if different items have different VAT rates, then show this for each one

Issuing international invoices

If you sell products or services to international customers, issuing an invoice is likely to be a requirement.

There are some extra things to think about when creating your invoices for international sales. Firstly, it’s likely you’ll need to include IBAN, SWIFT, or BIC numbers – these are numbers and codes that help international customers to identify your bank.

You’ll also need to consider the impact of exchange rates. International invoices are usually paid in common currencies like sterling, dollars, or euros but can be paid in any currency.

How to send an invoice

The quickest and easiest way to send your invoices is by email. You can attach your invoice in an un-editable PDF format (to prevent fraud) and include a clear, brief description of your business and invoice in the subject line and body of the email.

Different customers and clients might have different processes for receiving invoices. It might be a good idea to test if there’s certain information to include in the subject line that’ll help you get paid faster.

After you’ve sent an invoice, you could choose to give your customer a phone call to check they’ve received it – and if the payment isn’t forthcoming, you can give them a polite nudge.

Alternatively, there’s software that can take the hassle out of sending invoices. In some cases, you can create and send invoices directly from a mobile app.

If a customer has multiple outstanding invoices, you might also choose to send a statement of account to help them keep track of what they owe (and pay you on time).

At this stage, you may also want to consider sending a late payment or overdue invoice letter. Read our guide on how to write a late payment letter and download your free templates for a polite nudge, firm reminder, and final demand letter.

What are the most common invoice payment methods?

Most businesses accept a variety of different payment methods. It’s important to include what payment methods you accept on your invoices so customers know how to pay you.

The table below shows some of the most common types of payment methods and what needs to be included on an invoice.

Payment method | What to include on an invoice | Considerations |

Credit/debit card | N/A | You'll need a merchant account and card reader, which can be costly |

Bank transfer | Your bank name, sort code, and account number | Funds can take three working days to clear |

IBAN/SWIFT/BIC | Your IBAN, SWIFT, or BIC numbers | SWIFT is needed for payments from the United States and Canada |

Cash | N/A | Most businesses can only accept cash from consumers and you may be charged for depositing it |

PayPal | Your PayPal account details – usually an email address | You'll have to pay various fees |

What about invoice software?

You can use our selection of free downloadable invoice templates to take the stress out of creating your own invoices from scratch.

But if you want to know how to make an invoice yourself, you can also have a look at our list of the best invoice apps for even more invoice template options.

Some digital banks and mobile-only challenger banks even offer an invoice generator to create and chase invoices for you, taking the hassle out of record keeping.

Do you have any more questions on how to write an invoice? Let us know in the comments below.

More guides for small businesses

Is your business insured?

We have over 900,000 UK customers plus a 9/10 satisfaction score. Why not take a look at our expert business insurance options - including public liability insurance and professional indemnity - and run a quick quote to get started?

Start your quote

Written by

Sam Bromley

Sam has more than 10 years of experience in writing for financial services. He specialises in illuminating complicated topics, from IR35 to ISAs, and identifying emerging trends that audiences want to know about. Sam spent five years at Simply Business, where he was Senior Copywriter.

We create this content for general information purposes and it should not be taken as advice. Always take professional advice. Read our full disclaimer

Keep up to date with Simply Business. Subscribe to our monthly newsletter and follow us on social media.

Subscribe to our newsletterInsurance

Public liability insuranceBusiness insuranceProfessional indemnity insuranceEmployers’ liability insuranceLandlord insuranceTradesman insuranceSelf-employed insuranceRestaurant insuranceVan insuranceInsurersAbout

About usOur teamAwardsPress releasesPartners & affiliatesOur charitable workModern Slavery ActSection 172 statementSocial mediaSite mapAddress

6th Floor99 Gresham StreetLondonEC2V 7NG

Northampton 900900 Pavilion DriveNorthamptonNN4 7RG

© Copyright 2024 Simply Business. All Rights Reserved. Simply Business is a trading name of Xbridge Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Registration No: 313348). Xbridge Limited (No: 3967717) has its registered office at 6th Floor, 99 Gresham Street, London, EC2V 7NG.