Wondering how to file a VAT return and pay your tax bill to HMRC? It can feel overwhelming if you’re a newly-registered small business and trying to understand all the forms and processes.

Fortunately, this guide explains how to do a VAT return online and the different rules if you’re using one of the special accounting schemes.

And if you’re not sure whether you need to register, or how much VAT costs, we have detailed guides on these topics too.

This guide covers the following:

- what is a VAT return?

- filing your VAT return online

- submitting your VAT return

- VAT return deadline

- VAT return example

- VAT return boxes

- special accounting schemes

- what happens if you don’t file your VAT return on time?

What is a VAT return?

A VAT return is a digital form you send to HMRC showing how much VAT you owe.

It includes how much VAT you’ve charged on sales minus the amount you can reclaim on goods and services you’ve paid for.

It’s a form that’s usually submitted every three months, based on your business’s accounting period.

Filing your VAT return online

The introduction of Making Tax Digital now means all VAT returns must be filed electronically. You can do this through your VAT online account on the government website, third-party VAT return accounting software, or with help from an accountant.

It’s important to note that you can only use the government’s VAT online account if you use the annual accounting scheme.

Filing your return by post is only allowed if you have an exemption from Making Tax Digital for VAT.

How to submit a VAT tax return

If your business has registered for VAT then you’ll need to file a VAT return.

When you file a VAT return, you’re telling HMRC how much VAT you’ve charged and paid to other businesses. Usually, you’ll need to submit a VAT return every three months to HMRC.

It’s easy to get confused by the boxes on a VAT return and what information you need to include. The government website has more information about sending a VAT return.

As mentioned, you need to keep digital VAT records and use accounting software to send your return as part of Making Tax Digital.

Make sure you submit your VAT return on time to avoid penalty points, and late payment penalties.

When is the VAT return deadline?

Your VAT return due date is based on your accounting period.

VAT returns are usually due four times a year but you might choose to pay monthly or even file once a year through the annual accounting scheme.

For most businesses though, your deadline for VAT return will be quarterly – and this will also be when you need to pay your bill.

If you log into your VAT online account you can see when payments are due.

VAT return due date

You send your return and pay VAT due one calendar month and seven days after the end of your VAT period.

Some businesses can pay monthly, which means a different VAT return dates.

Others might join the annual accounting scheme. This removes quarterly VAT return deadlines. Instead, you make advance payments towards your bill and only send one return a year.

Your VAT due date if you’re using the annual accounting scheme is two months after the end of the period.

Because of the annual frequency, this scheme won’t suit businesses that regularly reclaim VAT, as they’ll only get one refund a year. Speak to an adviser if you’re not sure.

You can always check your VAT online account on the government website to find out your VAT deadlines.

VAT return example

If you’re filing your VAT return on a quarterly basis, here’s an example of when VAT might be due based on an example accounting period.

If the end of your VAT period is 30 September 2023, the VAT deadline for sending a return and paying your bill is 7 November 2023.

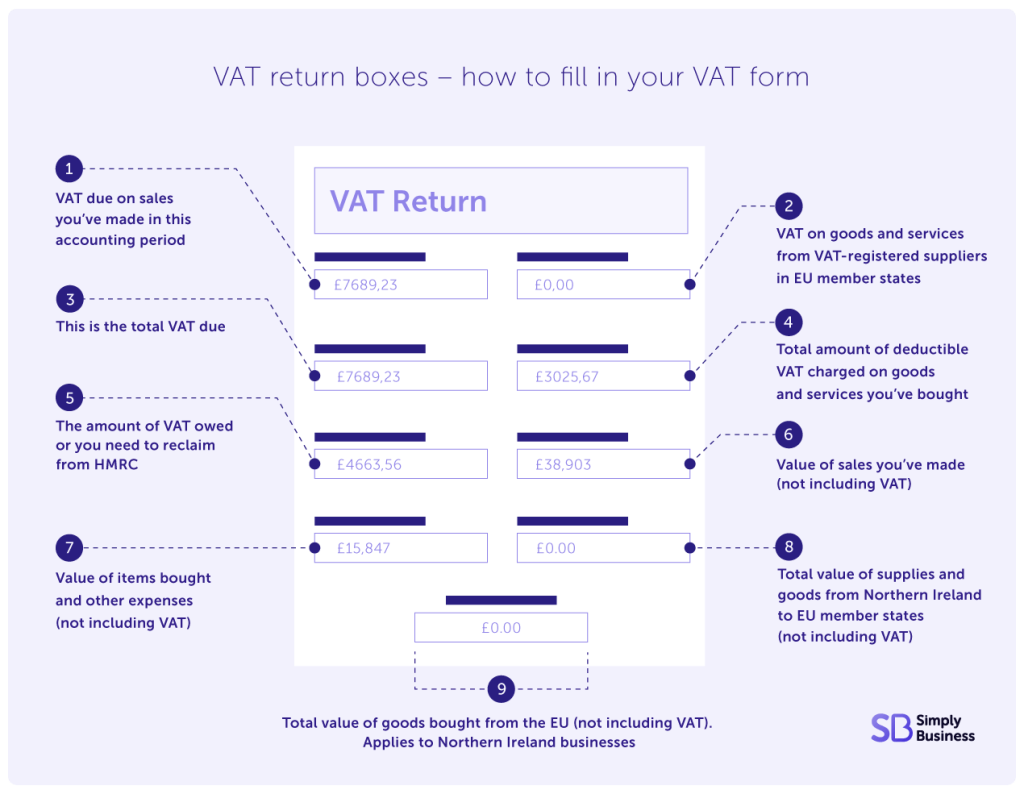

VAT return boxes – how to fill in your VAT form

Your VAT return form will have nine boxes.

It’s important to note that VAT accounting for businesses in Northern Ireland changed following Brexit – boxes 2, 4, 8, and 9 now have wording to reflect the Northern Ireland protocol. This means some boxes on the form won’t apply to you if you’re a UK business based outside of Northern Ireland.

There’s detailed information on what goes in each box on the government website, but here’s a quick overview of what to include in your VAT return box by box:

Box 1 – VAT due on sales you’ve made in this accounting period. This might also include VAT on other outputs, such as supplies to your staff and the sale of assets

Box 2 – VAT due on goods and services you’ve acquired from VAT-registered suppliers in EU member states. This applies to Northern Ireland based businesses only

Box 3 – this is the total VAT due (add the totals from box 1 and box 2 together)

Box 4 – this is the total amount of deductible VAT charged on goods and services you’ve bought for your business. This should include acquisitions in Northern Ireland from EU member states

Box 5 – the amount of VAT you owe HMRC or you need to reclaim from HMRC (based on the difference between box 3 and box 4)

Box 6 – value of sales you’ve made (not including VAT)

Box 7 – value of items you’ve bought and other expenses (not including VAT)

Box 8 – total value of supplies and goods from Northern Ireland to EU member states (not including VAT). This only applies to businesses operating in Northern Ireland and trading with the EU

Box 9 – total value of goods you’ve bought from the EU (not including VAT). This applies to Northern Ireland businesses only

What if you’re using a special accounting scheme?

The process for filing your VAT return is slightly different if you’re using one of the special accounting schemes, including:

- flat rate scheme

- cash basis accounting

- annual accounting

- payment on account

- reverse charge accounting

For example, if you’re using the flat rate scheme, completing VAT boxes 1, 4, 6, and 7 will follow a different process:

Box | Requirements |

|---|---|

Box 1 | Based on your flat rate percentage of your supplies |

Box 4 | Won’t usually need to be completed |

Box 6 | Based on your turnover you applied your flat rate to (including VAT) |

Box 7 | Won’t usually be needed. |

As always, speak to a professional if you’re not sure of anything.

What if you don’t file your VAT return on time?

HMRC has a central assessment process that estimates how much VAT is owed on an outstanding return. This is based on previous returns so can be much higher or lower than the actual amount owed.

Historically these central assessments would be cancelled the next working day after a late VAT return was submitted. However, HMRC now won’t remove the central assessment figure until the VAT return has been completely processed. This means taxpayers with returns that need to go through additional compliance checks may find their account isn’t updated until these checks are complete.

If the estimated amount is lower than the actual amount owed, you should notify HMRC within 30 days. If you don’t, there could be a penalty for a late VAT return of up to 30 per cent of the difference between the amount they estimated and the actual amount owed.

It’s worth noting that penalties are worked out based on this estimated tax owed.

Once you’ve submitted your return, you might want to pay the estimated amount to avoid any further penalties if there’s a delay to HMRC processing your tax return. But speak to an accountant or specialist advisor if you’re unsure of anything.

Do you have any unanswered questions about how to do a VAT return? Let us know in the comments below and we’ll do our best to answer.

Related small business guides

- What is the VAT flat rate scheme?

- Cash basis vs accrual accounting – what’s the difference?

- What is turnover – and how do you work it out?

- Is public liability insurance tax deductible?

Looking for self-employed insurance?

With Simply Business you can build a single self employed insurance policy combining the covers that are relevant to you. Whether it’s public liability insurance, professional indemnity or whatever else you need, we’ll run you a quick quote online, and let you decide if we’re a good fit.

This block is configured using JavaScript. A preview is not available in the editor.