UK house prices could rise by up to four per cent in 2025, according to housing experts and analysts. And looking ahead over the next five years, the average UK house price could increase by almost 25 per cent.

A forecast by Savills names Wales, the North West, and Scotland as the top three UK regions for house price growth. Perhaps surprisingly, London comes out worst for five-year growth and is expected to flatline in 2025.

As a landlord, it’s important to keep an eye on average house prices and whether they could go up or down in the future.

If average prices are rising, the future resale value of your property is likely to increase. If they’re falling it may not be a good time to sell, but it could be the right time to buy.

- UK house price predictions for 2025

- where could prices rise the fastest in 2025?

- UK house price forecast 2025-2030

- where could prices rise the fastest in the next five years?

- are house prices going up or down?

- what UK house prices mean for landlords

- house price predictions FAQs

UK housing market predictions for 2025

At the start of 2025, the majority of mortgage providers and property experts forecast that house prices would rise steadily this year.

Here’s an overview of some of the 2025 house price predictions from leading market commentators:

| Source | 2025 house price prediction |

| Zoopla | 2.5% rise |

| JLL | 3.5% rise |

| Savills | 4% rise |

| Knight Frank | 3.5% rise (revised from 2.5% in May 2025) |

| Capital Economics | 2% rise (revised from 3.5% in July 2025) |

Have these predictions come true?

Most market commentators anticipated average house prices to rise between two and four per cent this year.

Looking at Nationwide’s House Price Index, the average UK property price was up 2.1 per cent year-on-year in August 2025. Meanwhile, Halifax’s data showed a year-on-year rise of 2.2 per cent in August 2025.

The current rate of growth suggests that the majority of commentators who forecast house price rises this year are roughly on track (although actual growth is slightly lower than forecast).

This article is intended as a guide. Always speak to a mortgage professional or property expert if you’re not sure of anything.

Where could house prices rise the fastest in 2025?

Wales is forecast to record average house price growth of three per cent in 2025, according to Savills.

The global property firm has also forecast strong growth of 2.5 per cent for Scotland, the West Midlands, and the North West.

The UK average forecast for 2025 is growth of one per cent.

| Region | House price growth forecast |

| Wales | +3% |

| North West | +2.5% |

| Scotland | +2.5% |

| West Midlands | +2.5% |

| Yorkshire and the Humber | +2% |

| North East | +2% |

| South East | +1% |

| South West | 0% |

| London | 0% |

| East Midlands | -1% |

| East of England | -1% |

| UK | +1% |

London prices to flatline in 2025

Despite having the highest average prices, London is expected to record flat growth of zero per cent this year.

The worst areas for growth in 2025 could be the East Midlands and the East of England, with drops of one per cent forecast in both regions.

House price predictions for the next five years

Average prices have increased steadily in 2024 and 2025. But what could happen over the next five years?

The Office for Budget Responsibility (OBR) originally forecast prices to rise by 1.1 per cent in 2025. However, it revised its forecast in March to a 2.8 per cent increase.

It then expects house prices to grow by an average of 2.5 per cent each year until 2030.

Revised in July 2025, Savills has forecast:

| Year | House price increase |

| 2025 | 1% |

| 2026 | 4% |

| 2027 | 6% |

| 2028 | 6% |

| 2029 | 5.5% |

| Total | 24.5% |

With interest rates starting to fall and house price falls for the current cycle seemingly in the past, property price growth over the next five years looks set to remain strong.

Although the lows of the cost of living crisis have been left behind, prices may not reach the highs of the post-pandemic boom before 2030.

If you’re looking to buy a property soon, read our comprehensive guide to buy-to-let investment and our article on whether now is a good time to buy a house.

Where could house prices rise the fastest in the next five years?

The North West is the region with the highest forecast growth over the next five years at 31.2 per cent, according to Savills.

This is followed by Scotland at 29.4 per cent, Wales and Yorkshire and the Humber at 28.2 per cent, and the West Midlands at 27.6 per cent.

The UK average during this period is forecast at 24.5 per cent.

| Region | 2025 | 2026 | 2027 | 2028 | 2029 | 5-year total |

| North West | +2.5% | 5% | 7% | 7% | 6.5% | 31.2% |

| Scotland | +2.5% | 5.5% | 6.5% | 6.5% | 5.5% | 29.4% |

| Wales | +3% | 5.5% | 6% | 6% | 5% | 28.2% |

| Yorkshire and the Humber | +2% | 4.5% | 6.5% | 6.5% | 6% | 28.2% |

| West Midlands | +2.5% | 5% | 6% | 6% | 5.5% | 27.6% |

| North East | +2% | 4.5% | 6% | 6% | 5.5% | 26.4% |

| South East | +1% | 3.5% | 5% | 5% | 4.5% | 20.4% |

| South West | 0% | 3% | 5% | 5.5% | 5.5% | 20.4% |

| East Midlands | -1% | 3.5% | 5.5 | 6% | 5% | 20.3% |

| East of England | -1% | 3% | 5.5 | 5.5% | 5% | 19.2% |

| London | 0% | 2.5% | 4.5% | 4% | 3.5% | 15.3% |

| UK | +1% | 4% | 6% | 6% | 5.5% | 24.5% |

Where are house prices predicted to grow the slowest?

House price growth for London between 2025 and 2029 has been forecast at 15.3 per cent by Savills, the lowest of any region.

Other regions with lower growth include:

- East of England – 19.2 per cent

- East Midlands – 20.3 per cent

- South West – 20.4 per cent

- South East – 20.4 per cent

Are house prices going up or down?

Since the global financial crisis in 2008, UK house price growth has been strong and consistent. This is due to demand for homes outstripping supply, which inflates house prices.

From 2020, as a result of the Covid-19 pandemic, average prices increased even quicker as the government introduced a stamp duty holiday and more people looked to relocate.

Following big jumps in average property prices between 2020 and 2022, growth stalled over the next year with price drops recorded in many areas.

This was caused by a combination of economic uncertainty, a cost of living crisis, high interest rates, and rising inflation, which made it harder for people to buy properties.

Between 2023 and 2024, house prices started to grow again but slower. So far in 2025, annual house price growth has been rising at a similar rate.

Here’s an overview of average house prices over the last five years from some of the main data providers:

| Price index* | August 2025 | August 2024 | August 2023 | August 2022 | August 2021 |

| Halifax | £299,331 | £292,505 | £279,569 | £293,992 | £262,954 |

| Nationwide | £271,079 | £265,375 | £259,153 | £273,751 | £248,857 |

| Rightmove | £368,740 | £367,785 | £364,895 | £365,173 | £337,371 |

*Halifax and Nationwide figures are based on purchase prices from approved mortgages. Rightmove figures are based on asking prices for homes for sale

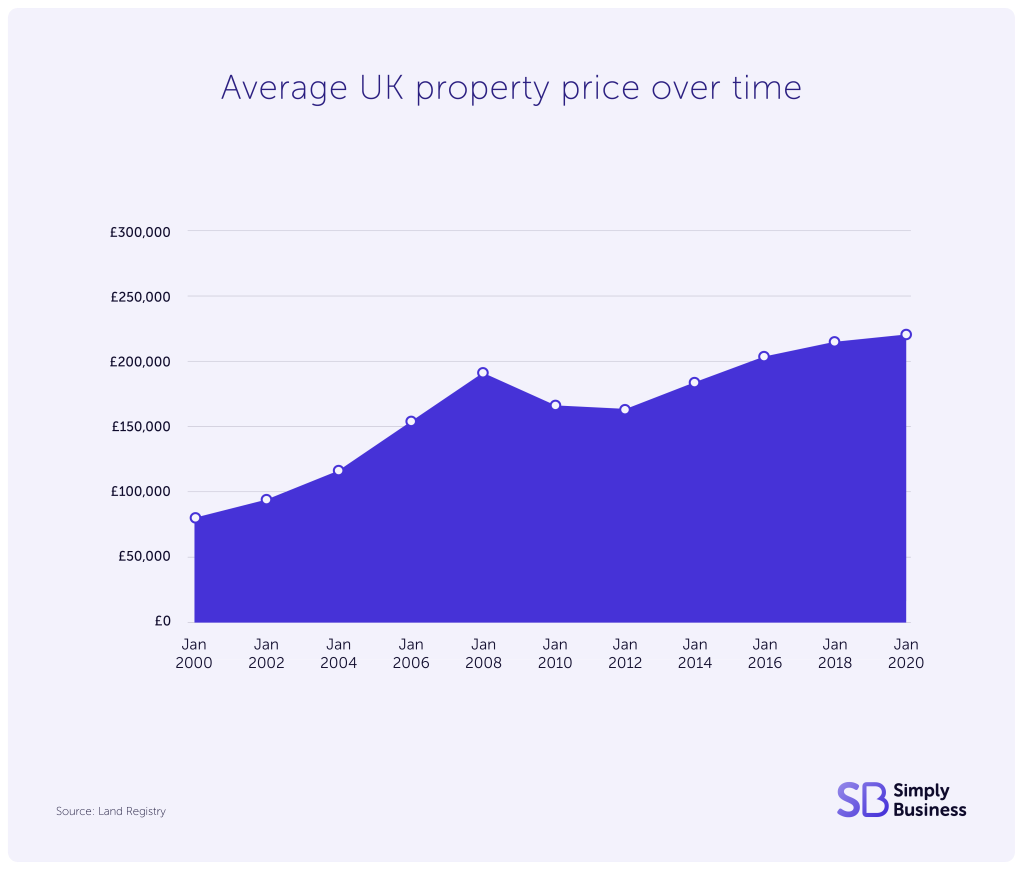

The below graph shows average UK house price growth over the last 20 years, according to the Land Registry.

Between January 2000 and January 2020, the average property price in the UK increased from £84,620 to £231,940 – a £147,320 rise, equivalent to 174 per cent.

UK property prices can be unpredictable

When looking at future house prices, there are plenty of factors to consider. A growing population could fuel demand for homes, while an ongoing shortage of new properties could restrict supply. This could lead average prices to continue growing.

Property remains a solid long-term investment for many people. And while it may be harder to buy than ever before, the majority of the population have aspirations to own their own home. This is in contrast to some European countries where lifelong renting is the norm.

In recent years it’s been very hard to predict what might happen in the next six months, let alone the next five years.

For example, no one could have predicted how a global pandemic would affect house prices, while the economic instability that caused mortgage rates to increase rapidly was also unexpected.

What is a house prices crash?

A house price crash is when average prices drop significantly and suddenly.

During a crash, a large proportion of homeowners would have to sell for a lot less than they’d like. A crash, also known as a period of decline or readjustment, usually follows a house price bubble (a sustained period of strong growth).

House price drops and ongoing economic uncertainty in 2022 and 2023 led to some speculation that there could be a housing market crash.

Although average prices did drop consistently during 2023, they quickly returned to growth which meant a house price crash was avoided.

The most recent house price crash happened in the aftermath of the financial crisis in 2008. The Office for National Statistics estimates that average prices dropped by 15 per cent between 2008 and 2009, with prices not returning to their pre-crisis levels until 2012.

UK house prices: what do they mean for landlords?

As a landlord, you’ll always be affected by house price fluctuations whether you’re looking to buy, sell, or keep your portfolio the same size.

Our 2025 research found that 13 per cent of landlords had sold a property in the last 12 months, with 27 per cent planning to do so in the next 12 months.

Here are some key points about house prices to consider in relation your rental property:

- mortgage rates and house prices are interlinked. High mortgage rates could impact the type of property you might be able to buy, plus how much your monthly repayments would be

- if average prices are rising, the value of your property could also rise which could benefit you if you come to sell in the future

- if average prices are falling, the value of your property could also decrease. This means it could be a bad time to sell but a good time to buy

- house prices go in cycles so keeping up to date can help you to make informed decisions when managing your portfolio

- the price you buy a rental property for affects its yield – the higher the rental yield, the better the return on investment

House price predictions FAQs

Are house prices expected to rise in the next five years?

House prices are expected to rise by an average of 2.5 per cent a year between 2025 and 2030, according to the OBR.

What will happen to UK house prices in 2025?

The majority of housing market commentators predict that UK house prices will rise between two and four per cent in 2025.

In August 2025, according to Nationwide, annual house price growth was recorded at 2.1 per cent.

How much will my house be worth in 2030 in the UK?

The average UK house price in 2030 could reach £300,000. By 2029, the average price will rise to £295,000, according to the OBR.

This would be a rise of over £30,000 between 2024 and 2030.

How much will house prices rise in 10 years in the UK?

House prices could continue to rise over the next 10 years. According to the OBR, the average UK house price will rise by an average of 2.5 per cent each year between 2025 and 2030.

It’s important to note that the economy, interest rates, and inflation all have an impact on house prices.

More guides for buy-to-let landlords

- Lettings agency fees for landlords – a guide

- Are buy-to-let mortgage rates rising or falling?

- Buy-to-let tax changes landlords need to know about

- Do landlords need contents insurance?

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.