What is a commodity code and why is it important to use the right ones when importing or exporting goods for your business? Here’s what small businesses need to know.

If you’re importing and exporting goods as part of your business, it can be difficult to understand the rules surrounding this. One thing you definitely need to understand is commodity codes.

Follow our step-by-step guide, with examples, to make sure you get it right – and avoid holdups and fines for your business.

Jump to section:

- What is a commodity code?

- What are commodity codes used for?

- Commodity codes: what do they look like?

- Commodity code checker: how to check a commodity code

- Make sure you use the right commodity codes

What is a commodity code?

You need to use commodity codes to classify your goods when you’re importing and exporting them.

You use a commodity code to look up the item and make your import or export declaration. It helps you work out:

- what rate of duty and import VAT you should pay

- whether the duty is suspended

- whether you need a licence to move your goods

- if your goods are covered by Agricultural Policy, anti-dumping duties, or tariff quotas

Commodity codes are also known as trade tariff codes or HS codes (harmonisation tariff codes).

Tariff codes mean your product can be recognised worldwide using a specific code, so there’s no hold-up due to language barriers.

What are commodity codes used for?

As mentioned, commodity codes are used for the customs declarations you need to make when importing and exporting goods to and from the UK. You declare the value and content of the goods that you’re importing or exporting.

The declaration is a legal document that lets customs authorities know you’re paying the right amount in tax and duties. The declaration also lets you and the authorities know whether the items are subject to licences or permits.

It’s important that the declaration is accurate, which is where commodity codes come in – problems with the declaration can hold up your items at the border.

Following Brexit, you now need to make customs declarations when importing and exporting goods from the European Union (EU). You might hear the term ‘TARIC codes’, which relate to the EU customs tariff system and are often also referred to as commodity codes.

Commodity codes: what do they look like?

Commodity codes vary in length depending on the type of item, whether they’re being imported or exported, and even how they’re made.

That’s because commodity codes get specific, which lets the authorities know exactly what they’re dealing with.

The government website gives the example of a pair of men’s trousers. You need to know how they’re made and what they’re made of before using the HMRC trade tariff tool (described below).

For example, if you run a clothing business, men’s trousers made from a knitted material that’s made primarily of cotton will have an export commodity code of 61 03 4200 and an import commodity code of 61 03 420000.

Commodity code checker: how to check a commodity code

You can use the HMRC trade tariff tool to find the right commodity codes for your business.

As discussed above, commodity codes are made up of different elements based on:

- the type of product

- the material used to make it

- the production method

So you need to have all of this information available when using the commodity code checker.

HMRC lists four steps when using this tool:

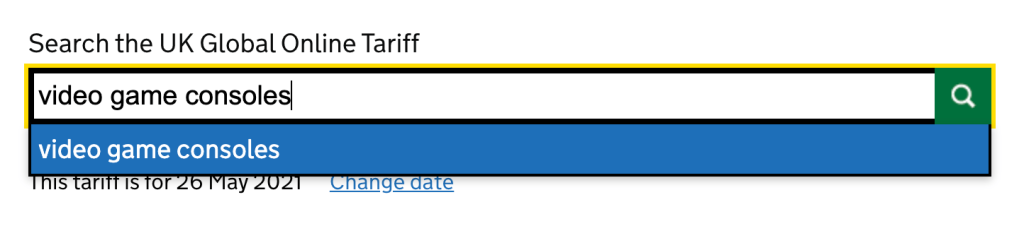

1. Search for your item

You’ll see a search bar when you access the tool – put the type of goods that you’re importing or exporting here and see what it comes up with.

If the goods don’t come up by name, you can try searching for what they’re used for or made from.

In this example, we’re searching video game consoles – for example, Sony PlayStation and Nintendo machines.

Source: gov.uk

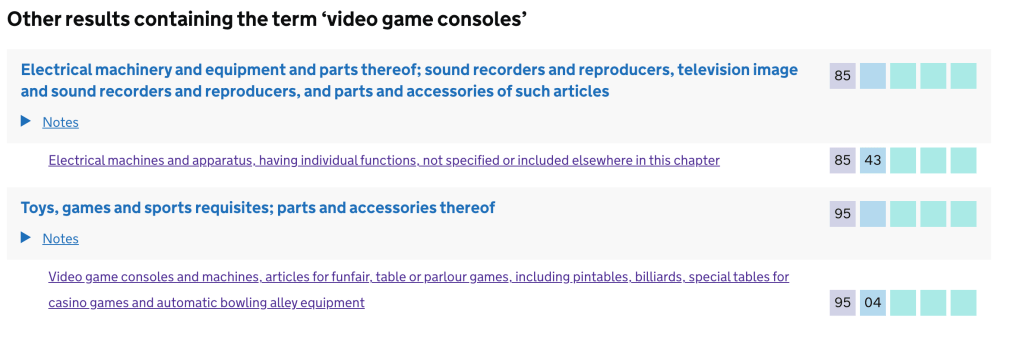

2. Consider the sections

After searching the item, different sections will show. You should check to see whether your goods are accurately described under these sections.

In this example, the ‘toys, games and sports requisites’ section, with a commodity code starting 95, most accurately describes what we mean by video game consoles.

Source: gov.uk

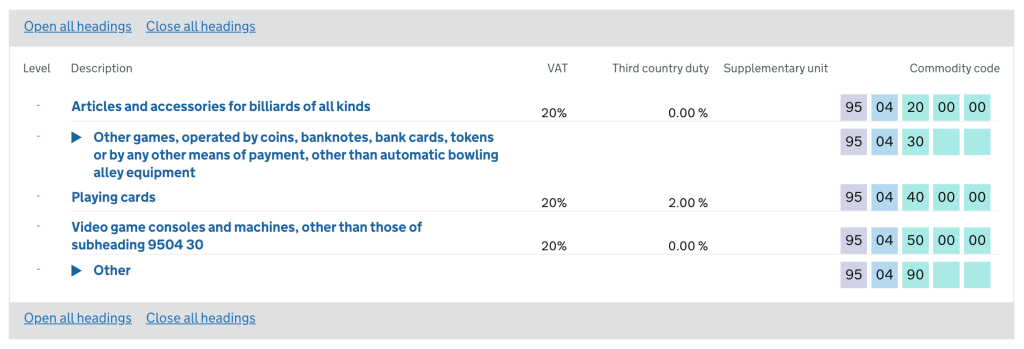

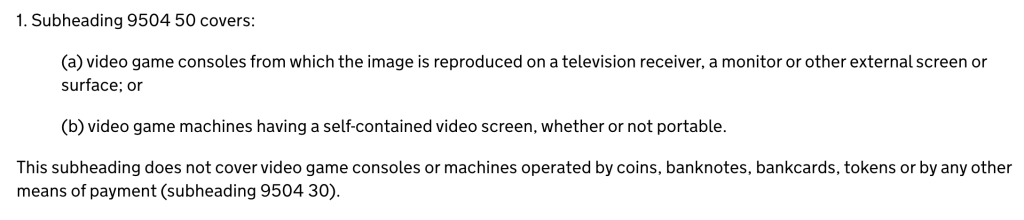

3. Check the subheadings

After clicking through on a section, you’ll see more subheadings. If your goods are specifically described under a subheading, choose that.

But in this example, our type of video game consoles are listed as more general ‘video game consoles and machines’, to separate them from coin-operated consoles you might see in seaside arcades.

Source: gov.uk

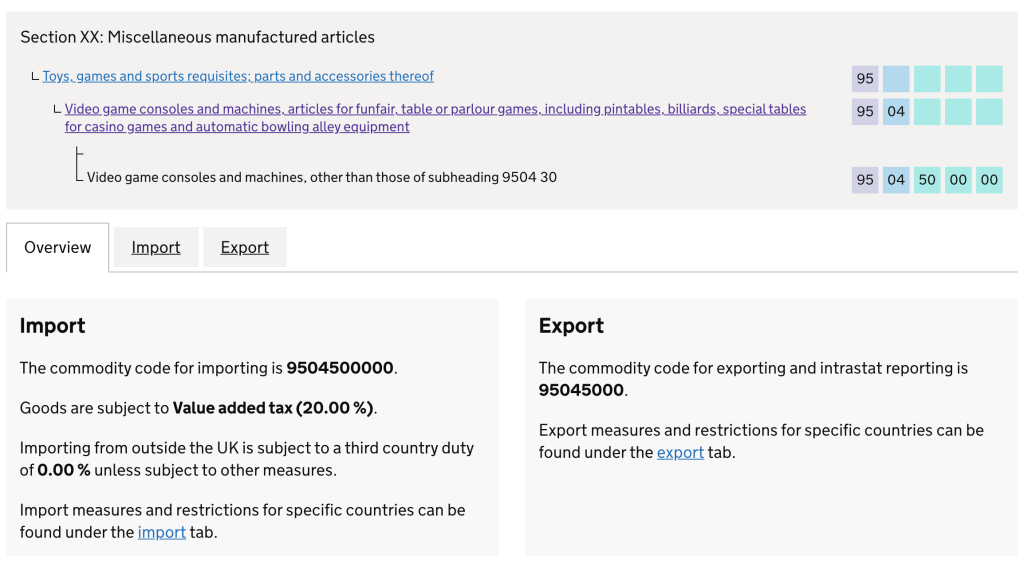

4. You should then see the right commodity codes

After clicking through, the tool should show you the commodity codes, as well as any duties, licences and permits needed.

Source: gov.uk

You can also check the footnotes to make sure you’ve got the right codes. The footnotes for this example tell us that the subheading 9504 50 is the right commodity code for Sony PlayStation and Nintendo consoles.

Source: gov.uk

Make sure you use the right commodity codes

If you make mistakes with the trade tariff tool and commodity codes, not only could it hold up your items, you might have to pay extra fees and charges.

In the worst cases, if you use the wrong commodity code and you don’t end up getting the right licences and permits, you’ll be breaking the law.

So, it’s important to be accurate. That said, commodity codes are complex, so you might want to get professional help if you import or export goods as a core part of your business.

Here’s what else you can do if you’re having trouble finding the right commodity codes:

- check HMRC’s specific guidance on hard to classify goods

- search the A-Z of classified goods for common products

- email HMRC’s Tariff Classification Service for informal advice – they aim to respond within five working days

- apply for a legally binding decision so that you’re confidently (and lawfully) using the right code – this is especially useful for new types of goods, or goods that are particularly hard to classify

What’s your experience of finding the right commodity codes for your business? Let us know in the comments below.

Small business guides and resources

- How to start an online shop – the ultimate guide to selling online

- How to apply for an EORI number: a guide for businesses

- Self-employed tax changes you need to know

- What type of business insurance do I need?

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Photograph: Siwakorn1933/stock.adobe.com