Whether you have a true passion for your craft and want to share it with the world or you just want to make some extra cash, the allure of side hustles is hard to ignore.

A side hustle often starts out as a hobby and a way to earn some cash on the side – but it can become a full-time career if you make a success of it. Our comprehensive guide gives you all of the information you need to get started – from side hustle inspiration to understanding your tax and legal obligations.

Side hustles: a rising trend

You might think that doing what you love and making money from a side hustle is only something to dream of. But more and more people are taking the leap to start their own businesses on the side of full-time employment.

In fact, 40% of businesses started as a side hustle (according to the results of our 2023 SME Insights Report.

This is no surprise, as the additional time and unstable job prospects of Covid-19 caused more people than before to experiment with side hustles. Our data also revealed the industries with the highest proportion of businesses that started as side hustles:

The sectors with the lowest proportion of businesses starting out as a side hustle include healthcare (16 per cent), transport (19 per cent), and finance and legal (21 per cent).

How to start a side hustle

But how do you actually start a side hustle? These five steps will help you get started.

1. Find your niche

You may already have an idea in mind for your new business venture – or you might still be figuring that out. If you’re still looking for a business idea, check out the top business trends or common side hustles.

Once you know what you’re doing, you’ll need a business name – this business name generator can help if you’re struggling.

2. Understand the legal side

All businesses, even side hustles, require you to have a decent understanding of business legal structures. There are three types of business structure to choose from: sole trader, partnership, or limited company. We’ll go into more detail later in the guide.

3. Find out if you’ll need to pay tax

Everyone has a £1,000 tax-free trading allowance, so you don’t need to tell HMRC about any income if it’s less than that in one tax year.

But if your business does well and you’re likely to go over that threshold, make sure you’re registered as self-employed and that you file your tax return in January.

4. Find funding

You may already have the funds to start your side hustle – especially if you’re starting small. But if you’re already thinking big, then this is the perfect time to look into business grants, or even crowdfunding, to get a bigger budget.

5. Make sure you’re insured

Even if you’re only trading part-time, it’s important to make sure you’re protected. Insurance covers you against the everyday risks of running a business such as accidents, damage, and legal fees.

Follow your dream: watch this idea turn into a business

Starting a side business is never a piece of cake – or pie – but Rourke’s pie shop, run by Gary Rourke, made it happen. Hear his story and get some advice from someone who made the leap.

Side hustle ideas: ways to earn a passive income

Setting up a passive income stream is one way to earn money without actively working – perfect if you’re looking to make some money on the side.

Most passive income streams require some work or investment up front, but if you’re successful you can keep earning an unlimited amount of money over time.

Earning passive income is appealing as the roles don’t tend to be labour intensive and can offer unlimited earning opportunities.

However, it’s important to note that the market is increasingly competitive and it will likely take a long time before you earn enough to live off. But for those with the time to spare, they make great side hustle opportunities for people working a full-time job.

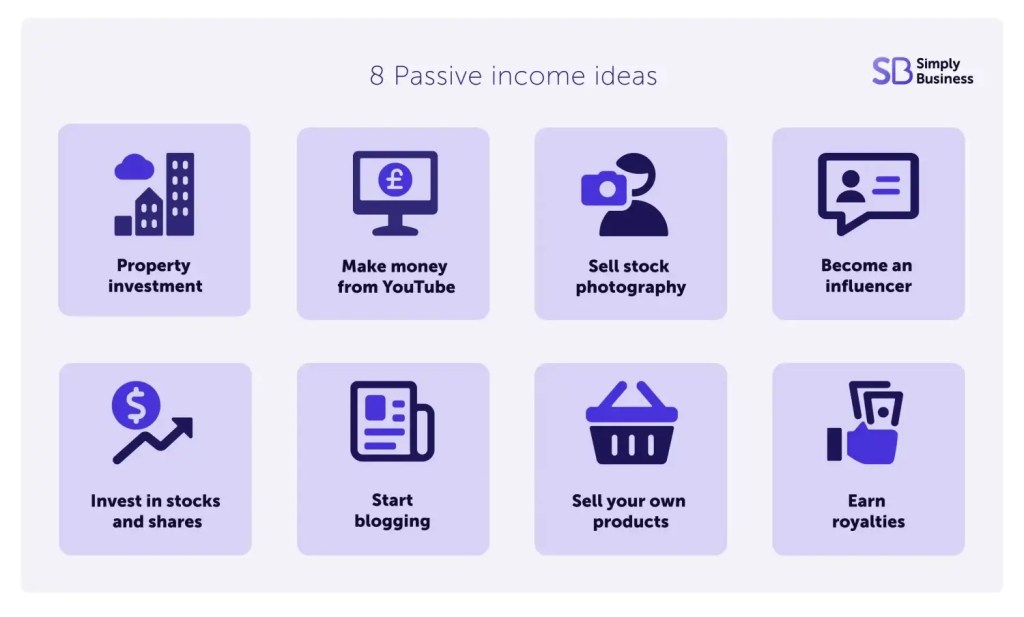

8 passive income ideas

1 .Property investment

Investing in property is one of the most reliable (and profitable) ways to make a passive income – but can be more hands-on than other income streams.

2. Make money from YouTube

Once you’ve reached 1,000 subscribers and your content has been viewed more than 4,000 hours in the last 12 months, you’ll be able to include ads in your videos. You can also experiment with affiliate marketing and paid brand placements if your content is popular. Learn more about making money on YouTube in our guide.

3. Sell stock photography

Websites like Shutterstock and Depositphotos allow you to sell your photography for either a one-off fee or a commission percentage each time an image is licensed by a customer.

4. Become an influencer

Social media platforms such as TikTok and YouTube can create a lucrative passive income for those who’ve developed a strong personal brand.

5. Invest in stocks and shares

One of the more traditional forms of passive income, you’ll get more out of investing the more you put in. However, you’ll need to do your research and make sure you’re aware of the risks.

6. Start blogging

From affiliate marketing to Google Adsense, blogging about your interests can be a great way to earn a passive income. It may take time and effort at the beginning, but if you write about what you love, is it really work?

7. Sell your own products

Whether you’re into arts and crafts or designing your own clothes, creative people everywhere are making a passive income by selling their products either online or in local stores.

8. Earn royalties

Make money off your passionate projects by earning royalties. Whilst not a common passive income stream, you can earn royalties by writing a book or releasing music if a publisher wants to distribute and sell your work.

Top business trends of 2023

If you’re still searching for that spark of inspiration, maybe one of these emerging industries could be a side hustle opportunity for you.

We’ve delved into our customer data, revealing the latest trends among small businesses and the self-employed, to predict some emerging trends for 2023 and beyond.

10 fastest growing trades for small businesses

- Project manager – project managers top the table with an impressive 71 per cent growth

- Property managing agent – property managing agents saw a 34 per cent rise making it our second-fastest growing trade

- Café owner – café owners increased by 31 per cent

- Security guard – self-employed security guards are among the top five fastest growing trades

- Gift shop – despite the challenging economic climate, we insured 21 per cent more gift shops last year

- Electrical engineers – self-employed electrical engineers rose 20 per cent

- DJ – more people are turning their hands to DJing – in fact our data shows the number of DJs rose by 18 per cent

- Dance instructor – our data shows the number of self-employed dance instructors increased by 12 per cent

- Food stall – food stalls have seen a 9 per cent increase – from tacos to Sri Lankan food, street food sellers are on the up

- Fencing contractors – fencing contractors increased by 9 per cent

Side hustles for students

If you want to turn a hobby into a successful business, these low-investment business ideas could test your creativity, resilience, and entrepreneurial spirit while you’re still studying.

While the ideas below are popular side projects, it’s important to remember your strengths, values, and interests. A genuine passion for what you do is key if you hope to turn this into full-time employment.

10 business ideas for students

What are you waiting for? Start your side hustle today

Once you’ve found your inspiration, it’s time to get to work. Whether you’re working on something that you love or have found a gap in the market to earn some extra cash, we hope you find success in whatever you choose to do.

Make sure that you find a healthy work-life balance in order to get the most out of your side hustle – as well as setting up your insurance cover to be fully protected against the unexpected.

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Photo: Pixel-Shot/stock.adobe.com