It’s important to know how to write a business plan, because it helps you answer questions about your business and recognise potential obstacles before you set it up properly.

Our guide explains everything you need to know, with tips from a successful business owner and a free business plan template.

While not all new businesses start out by writing a business plan, for many it’s an important step. It acts as your guiding document, helping you establish and grow your business, and it has a life well beyond just setting up or applying for funding.

But how to make a business plan, exactly? The first thing to know is that it doesn’t have to be too long and descriptive. You should be able to explain your idea clearly, structuring your plan into sections.

This comprehensive guide covers:

- free business plan template

- what is a business plan?

- how to write a business plan in 7 steps

- 4 top tips for writing a business plan

- how often should you update your business plan?

Download a free business plan template

To get started, why not download your free business plan template, which you can fill in as you work your way through our step-by-step guide?

Keep in mind that a business plan can take several weeks to write. It’s worth doing your research and taking your time to get the best result. And remember, you can continue to update and improve your business plan over time.

What is a business plan?

Starting a business is exciting. You’re bursting with so many ideas, you might be tempted to rush your plan to get to the fun stuff like selling your first product or posting on social media.

A business plan isn’t something you write down when you’re setting up and never look at again. You’ll refer back to it often, making sure you’re hitting your goals and getting the most from the brilliant ideas you come up with at the beginning.

And if you’re looking for funding or investment, your business plan needs to convince people to back your idea.

So it’s not an overstatement to call your business plan the ‘bible’ you’ll use to help establish your company.

And while business plans come in different formats, most of them include the same core sections.

According to Richard Burle, owner of Richard’s Garden Services in West Sussex, a business plan can help you to see where you’re going.

“They help you look at yourself, to make sure that you’re doing the best that you can for your business. That’s why a business plan is really important because if you haven’t got that, you’re probably going to fail.”

Business plan examples

Before you start writing, it might be useful to read an example business plan for some inspiration. A quick Google search will bring up lots of examples.

Whether you’re looking to start a business as a candle maker or dog walker, read some business plan examples to familiarise yourself with how to approach your type of business.

Once you’ve got an idea of how other businesses have written their business plan, it’s time to start writing your own.

How to write a business plan in 7 simple steps

If you’re clear on what you want your business to achieve, plus the key details of how it’s going to work, writing a business plan doesn’t have to be a difficult task.

We’ve broken everything you need to do into a business plan structure you can follow in seven simple steps:

- How to write an executive summary

- Introduce your business

- Analyse the market

- Complete a SWOT analysis

- Consider strategy and execution

- Understand your financials

- Include appendices

Step 1: How to write an executive summary for a business plan

The executive summary is essentially a one page business plan that goes at the beginning of your document. As it’s a snapshot of your plan, it’s often best to write it last.

This section is common in many business documents, from client reports to business proposals for new projects.

It’s designed to hook readers with your idea and give an overview of your plan, including:

- what makes you different

- how you’re going to market your ideas

- how much money you expect to make (and spend)

Step 2: Introduce your business

This is where you jump in and start talking about your idea. This section should include:

- the problem – what’s the need for your business? What’s the problem you’re solving, or what’s the opportunity? Why would people want what you’re selling?

- the solution – how are you solving the problem? What will your business do? How does it meet the needs you’ve identified? And importantly, how is it different?

- your history – how long has your business been established? If it’s new, what’s your experience in the sector or industry?

- business structure – who are its owners and what is its legal structure?

Richard Burle says it’s also good practice to plan “where you want to be in your first year, your second year, third year, and fourth year.”

“For example, the first year I spent by myself working and building up my customer base. Then after the first year, I got more people, more customers, and did the odd job on Saturday as well – so I brought on help for that.

“And then in my second year, I got my first contractor for two or three days a week – and after that it just increased,” he says.

Step 3: Analyse the market

Here you explain industry trends and the competitors you’re up against. It’s where you include the market research you’ve carried out.

This research can be quantitative (based on measurable data and statistics), qualitative (based on gathering individual experiences and opinions), or ideally both. This section should answer:

Where you’re selling (and who to):

- who are your potential customers and what are their characteristics?

- how will you target them?

- how many customers are you targeting? Will that number grow?

- where do those customers shop at the moment?

- do you have any existing customers, or confirmed orders?

Market trends

- how is the market changing? Is it growing?

- are tastes changing? What are the reasons?

The competition

- how will you attract customers from your competitors?

- what advantages and disadvantages do you have against them?

- how do you think your competitors will react when you start out? How will you respond?

When assessing the competition, gardener Richard says it’s not only important to look at the prices your competitors charge but also to list five good things each company does. You can use a competitor analysis to answer key questions about your competition.

Here’s a business plan example of a competitor analysis for a new plumbing company planning to launch in the Epsom area of Surrey.

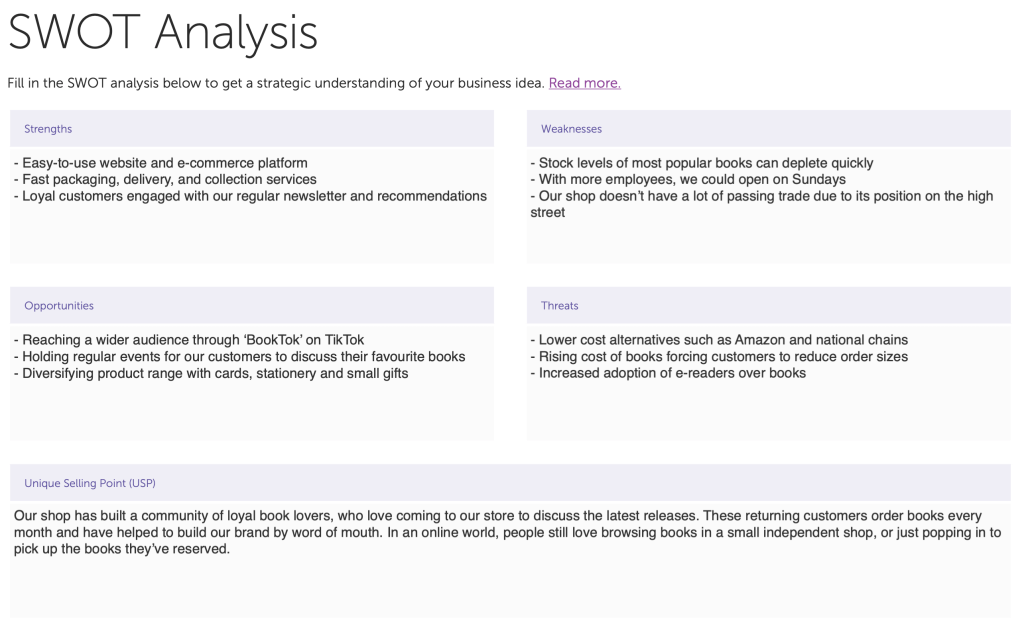

Step 4: Complete a SWOT analysis

SWOT stands for strengths, weaknesses, opportunities and threats. This is a very important part of your business plan, because it helps you drill down into your idea. You usually format a SWOT analysis in a grid on one page – four squares, one for each section. Then you make notes in each square.

Formatting the SWOT analysis in a grid helps you see how the different elements of your idea interact. For example:

- how will your strengths help you capitalise on opportunities?

- how will your weaknesses amplify threats – and what strengths can help you overcome them?

Completing SWOT charts for your competitors too should help you see how to win business from them.

Read more about creating a SWOT analysis.

Step 5: Consider strategy and execution

Now that you’ve done some analysis, in this section you can explain how you’re actually going to run your business.

Here you’ll include a number of sub-sections:

Marketing and sales

Explain more about your product and service, including its features and benefits. Talk about your pricing strategy, and how you’re going to promote your product. And how exactly are you going to sell? Which channels will you use – is it direct to the customer, online, or through other retailers?

Download our free marketing plan template to get started and read our ultimate guide to marketing for more information.

Operations

Where’s your location and what premises are you looking at? Is it suitable for long-term growth? How are you going to keep accurate records (for example, of stock, sales, accounts, and quality control)?

Your team

Are you the only one running your business or are you planning on hiring staff? How will you structure your team? Outline each team member’s experience and what they bring to your business. You might also want to include any outside advisors and experts you’re using, like accountants.

Step 6: Understand your financials

Here you detail the numbers – especially important if you’re looking for investment. The financials need to be realistic, accurate, and watertight.

Here’s what to include, presented in raw figures and charts:

- sales forecasts and the cost of goods sold – estimate what your sales will be in the future, listing the goods or services you’re selling as well as the cost of each unit. From this, you can estimate profit

- a profit and loss forecast – an overview of sales, cost of sales, overheads, profit and loss

- cash flow statement – cash flow is what keeps you afloat – with no money coming in, you can’t run your business. The cash flow forecast shows you how much money you generate over a period of time, as well as what you’re paying out

- balance sheet – shows an overall picture of your financials at a specific point in time. The balance sheet summarises your assets (what you own), liabilities (what you owe), and equity (the net difference when you subtract liabilities from assets)

The detail you need here depends on what stage you’re at with your business, as well as the size of your business. You might want to ask for expert help and advice on crunching the forecasts.

Step 7: Include appendices

While the business plan itself shouldn’t be long and complicated, there might be information you choose not to include in the body of the plan. Adding an appendix means that people are able to refer to this extra detail if needed.

This can include graphs, tables, and notes. You can signpost the relevant appendices people should look at throughout the body of the business plan.

Four top tips for writing a business plan

When you’re using business plan templates, keep the following four tips in mind.

1. Know your audience

Remember who you’re writing for – is the business plan primarily for your own use, or are you looking for a loan, or even equity investment? Keeping your audience in mind will help you stay on track.

2. Keep it concise

Make sure your plan is snappy and to the point. While you don’t want to miss out crucial details, you should also bear in mind people’s attention spans. Don’t turn in a 100-page plan.

3. Keep it simple

It’s likely your plan will be seen by people who don’t have intimate knowledge of your industry, so you need to make sure that it’s written in language that’s accessible to people without specialist experience.

4. Don’t forget the presentation

Tables, graphs, and charts can help you get information across better than blocks of text. It’s also worth thinking about how to pitch your plan to investors, potentially in a presentation that gives the toplines from your plan.

How often should you update your business plan?

As your business grows, you should refer back to your business plan regularly. As a minimum, you should be reviewing and updating it at least once a year.

When it comes to reviewing his business plan, gardener Richard focuses on expenses and prices.

“I think about whether I need to increase my prices, adding any extra costs and expenses that are going up – like fuel, clothing, and tools.

“I ask myself ‘can I increase my price?’ Sometimes you can, sometimes you can’t.”

He says it’s important to think about the ways you can increase your customer base and the type of work you want to take on.

“For example, I didn’t want to take on more hedging jobs so I put on my business plan that I was going to get somebody to do it for me.”

Now you’re all set with everything you need to know about writing your business plan. By taking the time to get it right, you can set yourself up for future success.

More guides for small businesses

- Going self-employed in the UK: a guide to get started

- Which bank has the best business bank account?

- How to register as self-employed

- Customer journey map template: why every business needs one

Get your business insurance sorted

We have over 800,000 customers plus a 9/10 satisfaction score. Why not take a look at our expert business insurance options – including public liability insurance and professional indemnity – and run a quick quote to get started?