Regardless of the size of your business, you’ll always be looking for ways to grow and develop it. But depending on where you are in your journey, it might not be clear how you can take your business to the next level.

In our simple guide to business growth, we’ll share tips on how to grow your business at every stage of its development. As well as ways you can plan and measure your business as it scales.

In this guide, we’ll cover the following:

- What is business growth?

- What are the five stages of business growth?

- Four ways to grow your business

- How to measure business growth

- Developing a business growth plan

- Business growth grants

- How to develop a growth mindset

What is growth in a business?

Developing a business can be achieved in a range of ways – from expanding your team or increasing sales figures, to launching new products or moving to new premises.

Organic growth is when your business expands without making radical changes. We’ll talk about this in more detail later.

Why is business growth important?

Growth businesses are in a strong position to attract the best talent, appeal to investors, and innovate to take advantage of new opportunities.

And with a focus on small business growth, you’ll be quick to identify what’s not working and how to improve your operations. Whether that’s improving customer retention or evolving your products, with the right strategy you could boost your profits and ROI.

What are the five stages of business growth?

When reading about business development, you’ll often come across the stages of growth. These stages outline the life cycle of a business so it’s important to know which stage your business is in.

We’ve put together an overview of the main stages below. It’s important to note that you’ll often see the stages described in slightly different ways with different names.

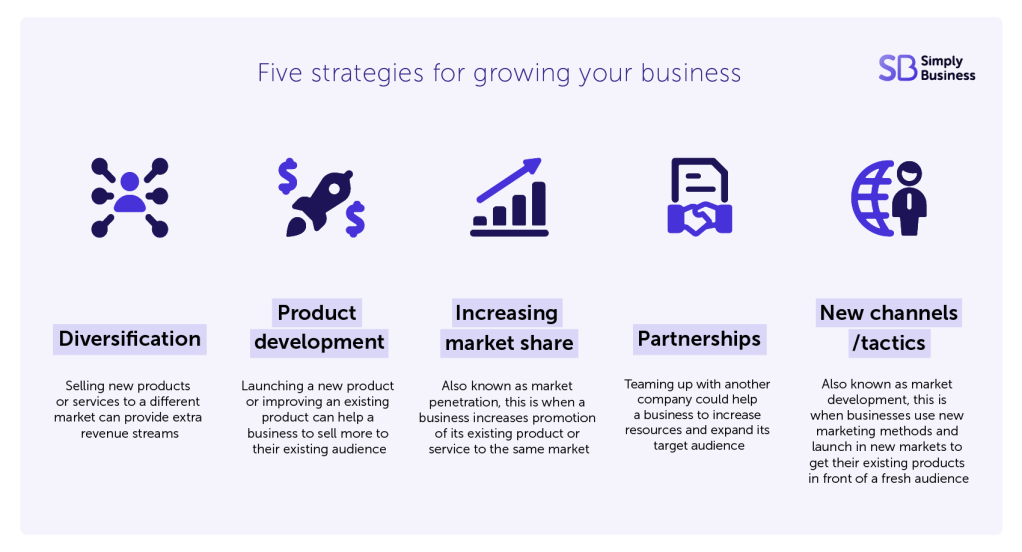

Four ways to grow your business

First, you should decide on the kind of growth that suits your business.

Organic growth

This type of growth is usually defined by internal changes in strategy. Typically, it’s achieved by only using resources from within your business, like increasing production for example.

A huge benefit of organic growth is that it’s self-sufficient and in theory should be a stable method of growing your business. This makes it the most suitable type of growth for small businesses in the early stages of their development because it’s the most cost-effective.

But it’s probably the most difficult type of growth because it’s harder to grow your business rapidly.

Some of the things you can do to keep your business growing organically are:

- diversifying your offering by introducing new products that connect with a new customer base

- developing your product or service so you keep your existing customers engaged

- evolving your advertising to attract new customers – whether that’s trying something new on social media, or exploring a different marketing channel

Strategic growth

Much like organic growth, strategic growth is a long-term method of expanding your business. The two main differences are what you change and how you fund it.

Strategic growth is usually funded with extra budget to build on your business’s regular strategy. And what you choose to focus on is a shift in strategy.

It can be targeting a new audience, or investing more into a new marketing channel – it’s about doing something different to grow your business in new areas.

Typically, more mature businesses will take this approach once they struggle to grow organically. This is for when a business is looking to expand.

Internal growth

Internal growth is about optimising your processes and improving efficiency – essentially, making your business operations ‘leaner’. This means you’ll look to cut any unnecessary spending and reduce waste as much as possible to maximise profit.

It’s difficult to rapidly develop your business just through internal growth, but when it’s combined with organic or strategic initiatives, it can help boost the development of your business.

This is most common for mature businesses but small business owners can still use some of the techniques, such as:

- keeping your business expensing as low as possible

- being efficient with your workspace and only having what you need

- assessing what you can do yourself and what you may need to outsource

Growth from external funding

Seeking funds from outside your business is one of the simplest ways to grow your business as it’s extra investment on top of what you already make. This will usually be in the form of investment, a strategic partnership, or an acquisition.

Something to consider with external funding is that you’re usually giving something in return, whether that’s a percentage of your business or profits – external funding usually comes at a cost.

This suits businesses of all stages of their development – but if you’re a business in the launch phase, you’ll probably need to show some track record of organic growth for someone to invest.

In our guide to business funding, we go into detail about how small business owners can get access to funding and investment opportunities – and which ones might suit you.

How to measure business growth

Once you’ve settled on how you’d like to grow your business, you’ll need to choose what your specific growth goals are.

Growing your customer base

Broadening the reach of your business to engage with new customers is a great way to grow your company. You’ll measure your success by how many new customers you acquire.

This could be email addresses, followers on social media, or an increase in foot traffic. The main thing is that you’ll be paying attention to the number of customers engaging with your business, rather than the amount of money you’re making.

Increasing revenue

Finding ways to make more money is important for every business. Here, you’ll pay attention to your cashflow forecast, turnover, and sales to see how your business is growing.

Do you need a business growth plan?

A business growth plan is similar to a business plan. The main difference is that it covers a shorter period of time, usually one to two years, rather than three to five years.

So, how do you start business development planning? Firstly, you’ll need to assess what stage your business is currently in (see below) and monitor performance. A good way to do this is by completing a SWOT analysis, which is a deep dive into your strengths, weaknesses, opportunities, and threats.

It’s also a good idea to set out your business’s USPs – what makes you stand out from your competitors?

Next, you’ll need to create a plan for how you want your business to grow and identify the company goals that’ll help you reach the next stage.

What to include in a growth plan

It’s important to break your growth plan down into sections, with clear objectives you want to achieve. Here are some of the key areas covered in most growth plans:

- growth strategies – which growth strategies are you going to use to reach your objectives? Are you looking to partner with other companies, or diversify your service?

- marketing – how many customers do you want and what marketing techniques are you going to use to reach them? Read our marketing guide for small businesses for some top tips

- operations – do you need to move to new business premises? Are there new suppliers you need to work with to reach your growth goals?

- people – does your business need more staff to grow quickly? Outlining the staff structure of your company and making sure the right people are in the right roles is key to future success. As your business grows, creating an organisation chart can help you to outline the hierarchy and structure of your company

It’s also worthwhile to include an overview of your financial information, such as accounts, profit/loss forecasts, and a cashflow forecast.

Business growth grants

A business growth grant is a cash injection that doesn’t need to be paid back.

In the UK, there are a range of growth grants available for small businesses, as well as grants for young business people, and businesses that take on apprentices.

Read our guide to small business grants for everything you need to know.

If you’re looking for another type of investment, read the following guides to get started:

How does the Business growth fund work?

The Business Growth Fund invests in small and medium-sized businesses across the UK and Ireland. It was set up in 2011 by a range of banks, including Lloyds, Barclays, and HSBC.

The fund has invested more than £2.5 billion in around 300 companies. It usually becomes a minority, non-controlling stakeholder in the businesses it invests in.

What is a growth mindset in business?

Growth mindset is an academic term that has become popular in business. It’s a belief that either your professional skills, or your business itself, can be improved through hard work and dedication.

It’s the opposite of a ‘fixed’ mindset, where you believe your business is limited by the skills and talents your employees already have.

The aim of having a growth mindset is that by focusing on learning and development, a business can thrive through innovation and new ideas.

However, declaring that your business or employees have a growth mindset won’t have an impact. You’ll need to be committed to changing the way your business operates from top to bottom.

Here are some of the qualities of a growth mindset in business:

- making sure everyone is accountable

- focusing on the purpose of your business

- prioritising learning and research

- learning not to dwell on failures and mistakes

- working towards long-term goals

Read more guides on developing a strategy for growth in business:

- How to create a small business customer retention strategy

- How to write a vision statement

- How to start a business

- How to find a gap in the market

What are your top tips for developing a business? Let us know in the comments below.

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Photograph: fizkes/stock.adobe.com

Photograph: fizkes/stock.adobe.com