So you’re thinking of starting a business? Here are the essential steps you need to get started – whether you’re building a business from scratch or want to make sure you’re doing everything by the book.

How to start a business – a summary

These are the key phases to starting a business in the UK:

- idea generation and validation – market research, business name, competitor analysis

- planning – choose a legal structure, create a business plan, apply for funding, decide branding

- launch – register a business name, create a marketing plan, set up website, organise accounting system, business insurance, tax responsibilities

- growth – develop new products, expand your business, hire staff

- maturity – plan for the future and adapt to changes in the market

Real-life tips on how to start a small business

We asked five business owners what it’s really like to start a business. Watch this video for tips, along with their highs and lows of business ownership.

How to start a business in the UK

From writing a business plan to understanding tax, benefits, and legal structures as a new business owner, our step-by-step guide explains how to start a business in the UK.

1. Choose your business idea

The first thing you need to do is choose your business idea. It should be something you’re passionate about so you’re happy putting your time, money, and energy into making it a success.

Start by checking if a product or service is viable by looking at Google Trends to see how popular your idea is. Then you could conduct market research, or even build a blog or social media channel to test if there’s enough interest.

You’ll need to find a niche so you can stand out to customers. Is there a gap in the market? Can you make use of specific skills and experience you have already? Do you have a unique perspective that will shake up your industry?

Related guides:

- Small business ideas – best businesses to start yourself

- 7 trending small business ideas for 2025

- 15 of the best home business ideas

- 11 of the best online business ideas

2. Register your business name

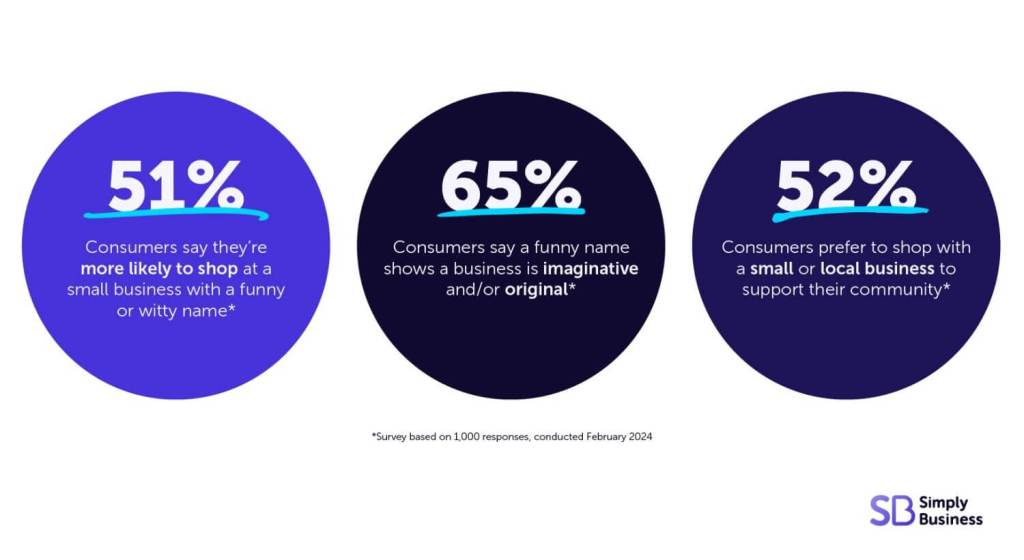

Coming up with a name for your business is an important step as it shows the personality of your brand and helps you stand out. Your name should be unique and appeal to your target audience – and it’s your chance to be creative.

Our winner of Britain’s Best Small Business Name is the perfect example of how important your business’s name can be.

It’s also worth understanding:

- how to define your brand so you can stand out from your competitors

- what you need to do to protect your intellectual property, including any patents and trademarks

3. Choose a legal structure

Next, you’ll need to choose a legal structure for your business:

- sole trader – the simplest business structure, but with no legal distinction between you and your business. This means if the business gets into debt, you’re personally liable

- partnership – if you’re starting a business with a business partner or partners

- limited company – a complex structure with plenty of admin, but your business is legally distinct from you as an individual. This means your personal assets aren’t at risk if the business gets into debt

If you’re not sure, this guide explains the difference between a sole trader and a limited company.

4. Write a business plan

A business plan is an important document for a business of any size. It helps you to get an idea of your strategic goals, financials, market research, and potential obstacles.

And as part of any new business strategy, you’ll need to create a budget. The cost to start a business can vary widely – it depends on things like whether you need to buy specialist equipment, rent a business premises, or if you’re running your business from home.

Our guide on how to write a business plan has a complete overview of writing your plan – plus a free downloadable business plan template too.

5. Secure funding and finance

How much money do you need to start a business? It’ll vary depending on your product or service – but you’ll need to think about this question before getting your new venture started.

You might not need much initial investment if you’re starting small.

But if you’ve identified a number of costs in your budget, you should know how you’re going to fund your project. Will you use savings? Or will you ask for help with starting up a new business (for example, loans from friends, family, or a bank)?

How to get money to start a business

Keep in mind you might be able to find grants for new businesses to help lighten the financial burden. The benefit of a small business grant rather than a loan is that you don’t usually have to pay the money back.

And there’s also the option of taking out a small business loan if that suits you and your financial circumstances. We compared seven small business loans from different lenders to see the pros and cons for small business owners.

Read more: Small business funding and investment: how to grow your business

6. Plan your advertising strategy

Now you’ve sorted your finances, it’s time to think about how you’re going to attract customers and grow your business.

When it comes to advertising a new business, you’ll need to consider marketing, branding, and how you’ll balance online and offline promotion.

Advertising strategy tips

- do competitor research – competitor analysis helps you understand the market, set your prices, and find a way to stand out

- build a social media presence – social media is a great way to showcase your brand’s personality and tone of voice, connect with customers, and even sell your products with tools like TikTok Shop and Instagram

- create a website with SEO – optimise your website for search engines so people can find your business and understand the products or service you offer

- send emails and newsletters – a simple and cost-effective way to keep in touch with your customers and boost sales

- network at industry events – get to know your industry and make connections at virtual or in-person events

7. Buy your new business insurance

The type of business insurance you’ll need depends on your business. Whether you have an online shop or deliver a service, you can tailor your cover and protect yourself from the costs of everyday risks like accidents, damage, and legal fees. You can also add specific covers if you need to protect stock or tools.

You can select from a range of covers:

- public liability insurance – this is important if customers visit your premises or you carry out work on client sites

- professional indemnity insurance – covers you if a client loses money because you provide negligent advice, services, or designs

- employers’ liability insurance – this is a legal requirement if you have employees

- legal expenses insurance – covers business legal expenses or prosecution fees

8. Understand your tax obligations

Running a business comes with legal and accounting responsibilities, so it’s important you’re clear on what’s involved. There’s a £1,000 tax-free allowance, but after that you’re legally required to register with HMRC or Companies House.

Sole traders need to:

Limited companies need to:

- register with Companies House

- pay corporation tax on the profits you make from your business

- file a company tax return

- pay VAT

- as a self-employed person, you’ll also need to send a Self Assessment

One of the benefits of registering as self-employed is you can claim back some of your expenses and reduce your tax bill.

A good way to test your business venture without as much financial risk is to start a business alongside full-time employment – but make sure you understand everything about paying tax when you have a side hustle first.

You may also be able to recoup some of the tax you pay with new business tax relief, such as business rates relief and VAT relief.

Finally, be sure to keep up with all the self-employed tax changes that are introduced in April each year.

9. Create a system for keeping business records

After you’ve worked out what you need to do for tax, it’s important to stay organised so you can meet your tax obligations at various points throughout the tax year.

If you don’t have a record-keeping system, you’ll spend a lot of time sorting paperwork when you have to do your Self Assessment – valuable time that could be spent running your business, or on relaxing and recharging. Read more bookkeeping tips here.

“I really wish I knew about the importance of keeping really detailed accounts before I started and actually buying accountancy software to begin with, rather than doing the traditional pen and paper route because it was very time consuming.”

Abi

Founder of Blackdown Blooms

Firstly, it’s a good idea to keep your business and personal finances separate. That’s because allowances like tax-deductible expenses can only be for business purposes – it’s much harder to separate money coming in and out when you’re using one account.

Many of the major providers offer a business bank account – here are some of the best.

What’s more, there’s lots of software available that can make record-keeping much easier. Software can do tasks like create and send invoices automatically, and monitor your income and outgoings:

Finally, you’re required to keep business records for a number of years. If HMRC asks for them, accurate and organised business records can help keep you out of trouble in the event of a tax investigation. Read more about how long to keep tax records.

Expert tips from successful business owners

You’ve read our nine steps on how to start a successful business, now you can learn more from some people who have already done it.

How to be a successful entrepreneur

Mark Mciver, CEO and founder of London barbershop SliderCuts, shares his three tips to being a successful entrepreneur.

- Study and work in your industry – know it inside out

- Be honest about your weaknesses – then hire in those areas to build a powerhouse team

- Invest into your idea – back your vision with some funding

Mark Mciver

CEO and founder of London barbershop SliderCuts

Many successful entrepreneurs have a strong instinct for what works and what doesn’t. After all, you know your business better than anyone.

Lucy Hitchcock is owner of Partner in Wine and Sassy Digital. And as the founder of two small businesses, Lucy has this to say to people just starting out: “Lots of people are going to have lots of advice for you when you are first self-employed, and my advice would be not to take it all.

“It’s your career. And it’s your job to do your own research, listen to your gut, and work out what’s best for your journey, your business, and ultimately the path you want to take.”

Challenges of running a business

There’s a whole host of challenges and opportunities that come with running a business. The business owners we spoke to shared how important boundaries are and making sure you manage a schedule so it doesn’t leak into your personal time.

They also spoke about the empowering nature of business ownership and being able to have complete flexibility over your time.

“The biggest challenge for me was the transition from a dark kitchen into somewhere that would be retail ready. That was a very expensive hurdle that we had to overcome. We’re launching into our first nationwide retailer imminently. So it was a big hurdle, but it was worth it.”

Natasha

Founder of The Vegan Patty Lady

‘One thing I wish I’d known…’

We asked business owners about what they wish they’d known before starting their business.

Kim, founder of The Only Way is Grooming, says how important it is that you learn to “trust your instincts” because “you’re the expert”.

And Kamara, co-founder of London-based lashes business TooTone, shared: “One thing we wish we knew was how hard it would be to build relationships with suppliers.

“We didn’t expect to have to sample our product so much just so they could get it right.”

The growth and maturity phase

Once you’ve established your business and have been turning a steady profit, you might start thinking about ways to expand and grow. This could mean developing new products or hiring staff – which bring a new set of challenges. For example, hiring staff means you’ll need to add employers’ liability insurance to your policy to stay in line with the law.

The final phase is business maturity, where you’re starting to think about selling your business, succession plans, or simply how to stay relevant in changing times.

How much does it cost to start a business?

How much it costs to start your business will depend on what you choose to do. There are businesses that you can start without money (read more below), while there are others with higher start up costs.

Starting a business in the UK costs £22,756 on average, according to research by Hewlett-Packard. This figure includes:

- incorporation costs

- legal expenses

- accountancy fees

- general administration

- employment costs

When you get started, for example, you might need £12 to register a limited company or £170 to trademark a business name.

You’ll also need to factor in costs for business insurance, tax, and possibly accounting. Then there’s your product or service itself – so you’ll need money for materials, supplies, or equipment.

Once you’re up and running, you’ll need to consider the cost of marketing or creating a website.

How to start a business with no money

While starting a business inevitably comes with costs, there are some ideas that can be cheaper to get started than others.

The amount of money you need to start your business will vary depending on the nature of it. Some businesses will naturally have more overheads than others.

You could set up a YouTube channel or start making money on TikTok, which can be relatively low cost depending on the equipment you choose. Or something like a dog walking or grooming business can often be started with lower start up costs.

You just need to be aware of the risks, clearly define your niche, and look for free ways to get your brand out there.

Here’s a few tips to get you started

- create a Google Business Profile to help get you noticed

- write a blog

- build an email list of clients

- advertise on social media

These guides go into more detail on low-cost strategies to grow your business:

What do I need to start a business?

Aside from a great idea that you’re passionate about, you’ll also need:

- courses and training – depending on your business, you might need specific training or want to complete a general business qualification, City & Guilds offer a range of vocational courses

- licences – check the government website to see if you need a business licence to sell food, play music, or trade on the street

- specialist equipment – make sure you budget for any equipment or tools

- products – if you’re setting up a shop or selling your own creations, you’ll need to get your stock together

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?