Buying a property can be a good long-term investment. But it’s important to remember that the property market moves in cycles so there are better and worse times to buy.

If you’re thinking of buying a rental property, is now a good time to do so? Read on to find out the best time to buy a house, the cheapest place to buy a house in the UK, and whether buy-to-let is still a good investment in 2024.

Is now a good time to buy a house in the UK?

Turbulent economic conditions over recent years have affected the property market. After years of low mortgage rates and high house price growth, mortgage costs increased rapidly. This caused average house prices to fall by 1.8 per cent over the course of 2023, according to Nationwide.

However, average prices have recovered during 2024. Figures from Nationwide show that the average UK house price was £261,962 in April 2024. This was 0.6 per cent higher than 12 months previously. In February, and March 2024, Nationwide recorded respective annual growth of 1.2 per cent and 1.6 per cent.

So what does this mean for landlords looking to expand their portfolios?

When prices were falling last year, it was seen as a good time to buy property due to lower competition from other buyers and a higher chance of getting an offer under asking price accepted.

And although more buyers have returned to the market in 2024 and price growth has started to recover, it could still be a good time to buy for landlords.

This is because house price growth and demand from buyers will encourage more people to sell, so in theory there will be more properties to choose from.

And with average house prices increasing, landlords can benefit from short and medium-term capital appreciation. This means you’re more likely to make a profit if you sell in the future.

That being said, a more active market makes research and targeting even more important for buy-to-let investors. Landlords should aim to identify the cheapest areas to buy property that have a thriving rental market.

If you’re planning to buy a property in 2024, you’ll need to consider the impact of high interest rates on buy-to-let mortgages. Monthly repayments are generally higher than they were a few years ago so you need to make sure you can afford them.

This article is intended as a guide. Always speak to a mortgage professional or property expert if you’re not sure of anything.

Is now a good time to buy a house in London?

London is known for having high property prices and a resilient market that can withstand uncertain economic conditions.

Despite this, prices did fall in the capital between 2022 and 2023. However, growth has returned in 2024. According to Halifax, the average property price in London reached £539,336 in April 2024, showing annual growth of 0.1 per cent.

And the rental market in London shows no signs of slowing down. According to Rightmove, average rents were:

- 12 per cent higher in the third quarter of 2023 compared to a year previously

- six per cent higher in the final quarter of 2023 compared with the same period in 2022

The property website reported a record high average monthly asking rent of £2,631 in January 2024. It also predicts average rents in the capital to grow by another three per cent by the end of 2024.

And while this growth is slower than the double digit figures recorded in 2022 and early 2023, it will still equate to an increased yield for many landlords.

So, despite higher average house prices, London remains a good place to buy for landlords due to high tenant demand, solid rental price growth, and long-term house price rises.

Read our guide on average rent prices in London for more detailed information.

Is now a good time to sell a house?

As the property market continues to recover from a turbulent period, it’s still currently in what is known as a ‘buyers’ market’. This means conditions favour buyers. With less competition for properties, there’s likely to be fewer bidding wars and sellers will be more willing to negotiate on asking prices.

With this in mind, now may not be the best time to sell a property. However, if you’ve owned a buy-to-let property for a significant period of time, it’s likely you’ll make a healthy return on your investment even in a buyers’ market.

For more tips on buying and selling a rental property, read our guide to buy-to-let investment.

When is a good time to buy a house for landlords?

The best times of year for buying and selling properties tend to be:

- January to spring – the start of a new year is a popular time for fresh beginnings

- early summer – better weather means people are keen to get out and view more properties

- autumn – following the summer holidays, buyers and sellers will be keen to get their business done ahead of Christmas

It’s widely considered that mid-summer (particularly during August) is a bad time to buy or sell as a lot of people go on holiday. On top of this, November and December are also unpopular months as people tend to put off plans before Christmas before re-entering the market in the new year.

As a landlord, you’ll need to consider the type of tenants you’re looking to rent to. For example, if you’re looking for a student property you need to buy it in time to get it ready for the next academic year to make the most of your investment.

Buying during one of the quieter times of the year could be a good strategy if you want to find a cheaper property with less competition. However, there’s likely to be less stock available and things might take longer to progress.

Where is the cheapest place to buy a house in the UK?

If you’re thinking about buying a property, it’s worth considering which areas have the cheapest homes and whether they’re suitable to rent out.

The table below shows 10 of the cheapest areas to buy property in the UK, according to Zoopla.

Location | Region | Median house price |

Shildon | North East | £69,650 |

Cumnock | Scotland | £79,030 |

Peterlee | North East | £85,300 |

Stanley | North East | £89,230 |

Greenock | Scotland | £93,790 |

Irvine | Scotland | £95,965 |

Crook | North East | £96,665 |

Hartlepool | North East | £106,340 |

Birkenhead | North West | £112,495 |

Workington | North West | £121,000 |

Before buying in one of these areas, it’s worth researching the local rental market. The combination of a low sale price plus solid rental prices means you could generate a favourable yield.

Read our article on the best buy-to-let areas for more inspiration.

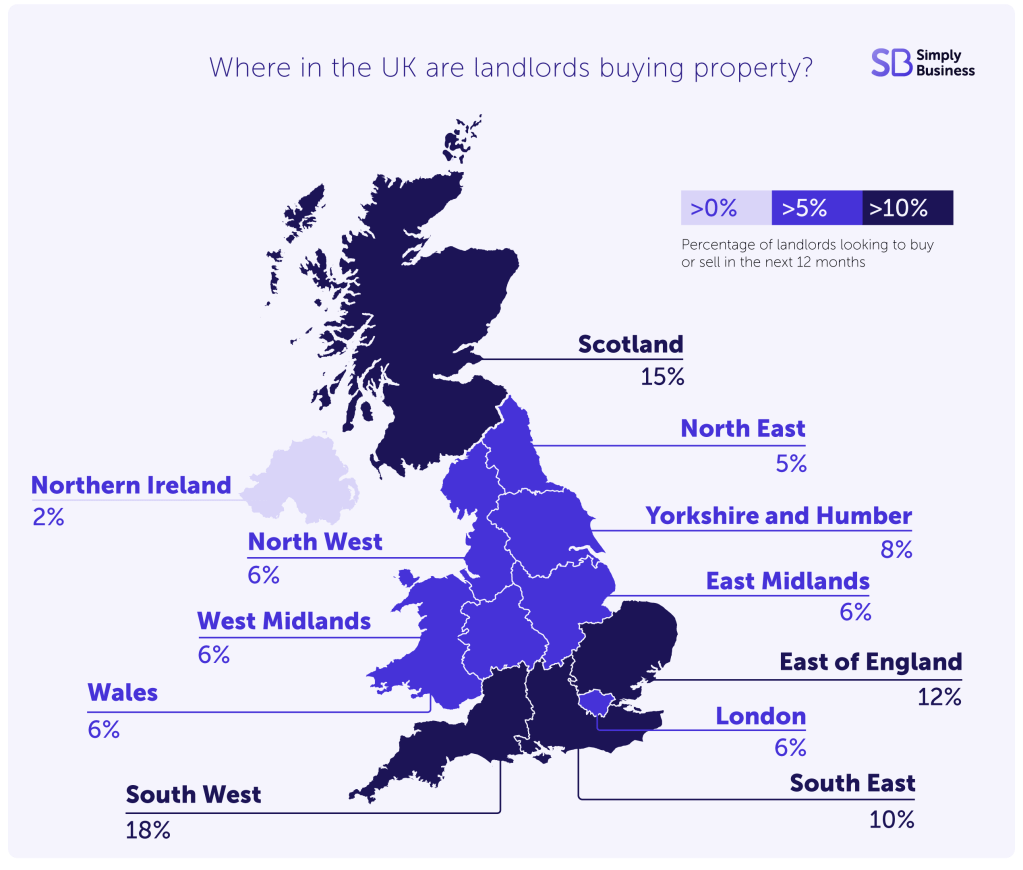

Where in the UK are landlords planning to buy property?

A Simply Business survey of 1,500 landlords found that three per cent planned to buy a property between 2023 and 2024.

Of those planning to buy, the most popular investment locations were:

- North West (18 per cent)

- Scotland (15 per cent)

- East of England (12 per cent)

The map below shows the proportion of landlords planning to buy a property in each UK region:

If you’ve got plans to buy a property, read our house viewing checklist to help you make the right decision.

Is property still a good investment in 2024?

Despite house prices growing at a slower rate than in previous years, property remains a good investment. This is particularly the case for landlords who are looking to hold on to their properties for the long-term.

Half of the 1,500 landlords we surveyed in 2023 said that they still consider rental property to be a good investment, with 37 per cent expecting their yield to increase by up to 20 per cent between 2023 and 2024.

The combination of monthly rental income and capital gains over time (with house prices expected to continue growing in the next few years), means landlords can benefit from a healthy return on investment.

Compared to other types of investment, such as stocks and shares, property is seen as one of the most reliable. This is because average values tend to rise over time, while people will always need homes to live in so demand is likely to remain steady.

Is it worth being a landlord in 2024?

From upcoming rental reforms to rising costs, there’s no denying that there are plenty of challenges for landlords at the moment.

Tax changes in recent years mean that renting out a property is less profitable for many landlords. However, as explained above, owning property for the long term remains one of the most reliable forms of investment.

Despite challenging conditions, rental demand continues to outpace supply. Rightmove data shows that across the UK there was an average of 20 individual enquiries per available rental property in 2023, compared to an average of six in 2019. This means that landlords are unlikely to have long void periods (times when their property is empty) while rental prices keep growing.

So despite a changing market, landlords who manage to find good tenants and keep them for the long-term will continue to see buy-to-let as a worthwhile investment.

Are you planning to buy a rental property this year? Let us know in the comments below.

More guides for buy-to-let landlords

- How to get a buy-to-let mortgage: a simple guide

- Rental reforms published – what do landlords need to know?

- Help with rent arrears – a guide for landlords

- Do landlords need contents insurance?

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.