Looking to set up a limited company but don’t know where to start? From choosing a name to preparing your documents and registering your company, we’ve got you covered.

Setting up a new business is exciting and you might be raring to get to the fun stuff – but understanding the different legal structures and their benefits is a key step in finding business success.

In this guide, we cover everything you need to know to set up your own limited company.

- What is a limited company?

- How to set up a limited company

- What is a private limited company?

- Why set up a limited company?

- How much does it cost to set up a limited company?

- How long does it take to set up a limited company?

- Closing a limited company

What is a limited company?

A limited company is a type of legal structure for your business. Limited companies:

- have a legal identity separate to that of its directors and shareholders (unlike sole traders)

- are therefore able to take on more risk than sole traders, who are personally liable for business debts that build up when things go wrong

- but setting up a limited company does come with added paperwork and responsibilities, making them time-consuming to run

There are two types of limited company: public and private. Small businesses are usually registered as a private limited company as they’re unlikely to be trading on the open stock market. We’ll go over this more later in our guide.

You can also get private limited by guarantee, but that’s only if you’re setting up a not-for-profit organisation. And limited liability partnerships is an option if you’ve set up a business partnership.

Here we look at how to set up a limited company, along with a limited company’s benefits and costs.

How to set up a limited company

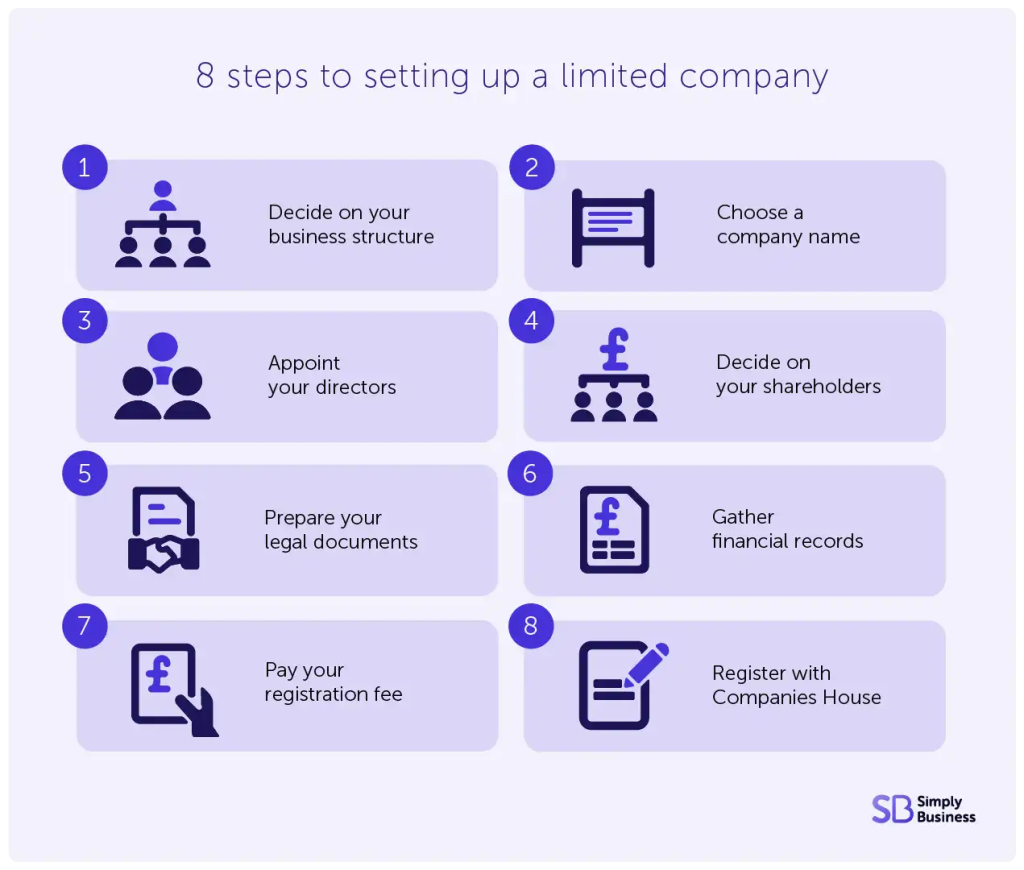

Follow these 7 steps (and questions to ask) when setting up a limited company.

1. Is setting up a limited company right for your business?

You should work out whether you need to set up a limited company in the first place.

Being a sole trader is the most common legal structure for businesses in the UK. At the start of 2023, there were 3.1 million sole traders – 56 per cent of total businesses in the private sector (Department for Business & Trade).

This is significantly more than the 2.1 million actively trading limited companies in the UK, which comes in at 37 per cent of total businesses.

It’s easy to set up as a sole trader and it comes with relatively few legal responsibilities, meaning it suits businesses that want to get started quickly.

But as we’ve already mentioned, sole traders have unlimited liability, which means they’re personally liable when something goes wrong. Being a sole trader can also be less tax-efficient.

Think about the type of business you’re setting up, and the risks involved. It’s usually a good idea to get professional advice if you’re not sure.

You can learn more about whether you should set up your business as a sole trader or limited company in our dedicated guide.

2. How do you choose a name for your limited company?

As two separate limited companies can’t have the same name, you’ll have to come up with an original name for your business.

Keep in mind that Companies House won’t allow anything offensive. They also have a list of sensitive words and phrases you can’t use.

Don’t forget you’ll need a digital presence so people can find your business. It’s important to check whether the name is available to use as a URL (you can do this using a domain checker).

As a limited company, your name will have ‘ltd’ after it (which is short for limited). If you don’t want to use limited in your name, then you have to complete ltd registration by post.

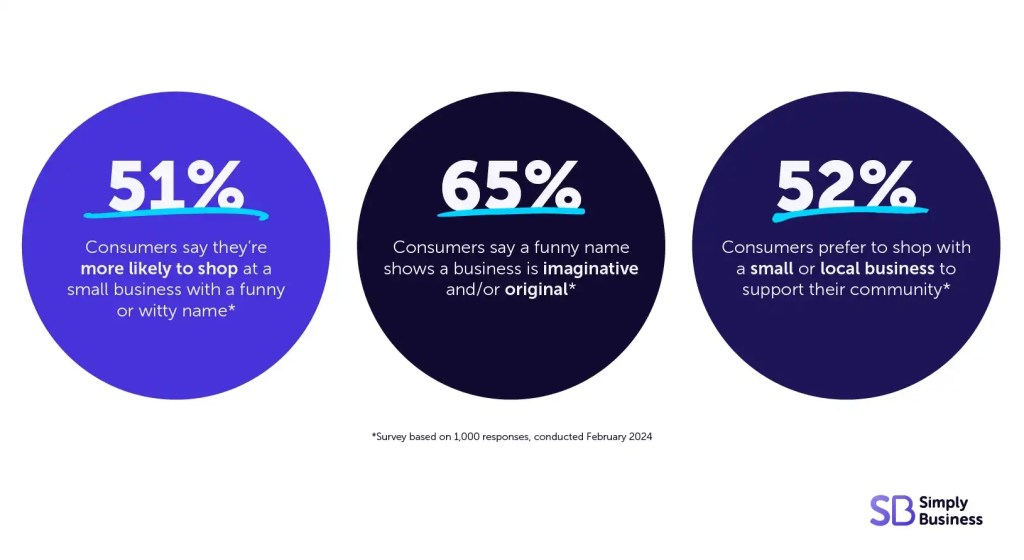

For some light-hearted inspiration on choosing a name, take a look at our business name generator.

We also have a whole guide to naming and registering your business – which comes with some insight on what the UK public like in a business name.

3. How many limited company directors should you have?

Every limited company needs at least one director (someone responsible for running the company), but there’s no limit on the number of directors a company can appoint.

When setting up a limited company, the director must be 16 or over and their responsibilities will range from legal to financial. The government website says that as a director you must:

- try to make the company a success, using skills, experience, and judgement

- follow the company’s rules shown in its articles of association

- make decisions for the benefit of the company, not yourself

- tell other shareholders if you might personally benefit from a transaction the company makes

- keep company records and report changes to Companies House and HM Revenue and Customs (HMRC)

- make sure the company’s accounts are a ‘true and fair view’ of the business’s finances

- file a company tax return and pay corporation tax

- register for Self Assessment and send a personal Self Assessment tax return every year – unless you run a non-profit organisation (like a charity) and you didn’t get any pay or benefits, like a company car

Avoid these responsibilities and you could end up facing penalties and even prosecution, so make sure you’re prepared to meet them before you incorporate.

A good accountant can help on the tax front, while insurance can keep your limited company protected. Explore our limited company insurance options.

4. Decide on your shareholders

A limited company needs at least one shareholder. Shareholders can also be directors.

As a small business, this might mean you will be the only shareholder. And if your business only has one shareholder, that shareholder owns 100 per cent of the company.

That said, there’s no limit to the number of shareholders a limited company can have.

When you register your limited company, you need to give information about the shares and how they’ve been issued. You should state:

- the number of shares and their total value (your company’s ‘share capital’)

- the names and addresses of your shareholders

It’s common for new small limited companies to issue 100 £1 shares and pay £100 into the company bank account when incorporating.

You can divide this if you have more shareholders. For example, if you have two directors, you can issue 100 £1 shares, with both shareholders paying £50 into the company bank account.

This means the company is divided equally between the two shareholders, but you could also split it unevenly if you wanted to.

What is a person with significant control?

You need to identify the people with significant control (PSC) in your business and tell Companies House about them on your company’s PSC register.

Companies House says PSCs are likely to be people who have:

- more than 25 per cent of shares in the company

- more than 25 per cent of voting rights in the company

- the right to appoint or remove the majority of the board of directors

5. Prepare a memorandum and articles of association

These are the documents that say how you’re going to run your limited company.

The memorandum of association is the legal document that all your initial shareholders sign, agreeing to form the company. It’s created automatically when registering your company online.

The articles of association are written rules about running the company, agreed on by the directors and shareholders. You can use model articles as a template, or create your own.

Check out our guide to memorandum and articles of association templates.

6. What records do I need to keep when running a limited company?

There are two types of records you need to keep:

- records about the company

- financial and accounting records

If you don’t keep accounting records, you could be fined £3,000 or disqualified as a company director, so it’s important to know your responsibilities.

The government website says that company records include information about directors, shareholders, and company secretaries, as well as:

- the results of any shareholder votes and resolutions

- details of loans that the company has promised to repay at a date in the future (‘debentures’) and who to pay them back to

- the payments a company makes if something goes wrong and it’s the company’s fault (‘indemnities’)

- details of share transactions

- details of loans or mortgages secured against the company’s assets

The government website says that financial and accounting records include information about all the money spent and received by the company, as well as:

- details of assets owned

- details of debts the company owes or is owed

- stock the company owns at the end of the financial year

- stocktakings used to work out that figure

- all goods bought and sold (and who from and to)

You also need to file a company tax return, which involves calculations about your company’s finances (including turnover, profits, and tax reliefs). You should keep accurate financial records to make filing your company tax return as easy as possible.

Generally, the government says you should keep records for six years from the end of the last company financial year they relate to, but there are situations when you might need to keep them for longer. These include if you buy something that you expect to last for more than six years, or if you filed your company tax return late.

Read more about keeping accurate tax records.

7. Incorporate a limited company

You’re now ready to register your company with Companies House, choosing an official address and SIC code (the code that identifies what your company does – for example, 69102 is a solicitor).

You can register via the Companies House website from £50, or through a variety of incorporation websites. Some accountants will even cover the cost for you as part of limited company accounting packages.

When incorporating you’ll need to provide Companies House with the residential address of each director, or a ‘service address’ if you’re keen to keep your details off the public register. You’ll need to provide your registered company address and statement of capital, which is a description of the share structure of your new limited company.

Read more about registering with Companies House.

Do I need to have a physical office address to register a limited company?

You can’t set up a limited company without providing a registered office address, as this will be where all written communication is sent to you.

This address needs to be a physical address in the UK – and you’re no longer allowed to use a PO Box for this purpose.

You also need to make sure that the address is in the same country you registered your business in. So if you registered your business in England, your registered address can’t be in Scotland.

This address will also be publicly available on the online register. So if you’re using a home address where other people live, you might want to think about which address is best to use.

What is a private limited company?

This guide is about setting up a private limited company (as opposed to a public limited company).

Businesses trading shares on the stock market (like the London Stock Exchange) must be public limited companies and are usually bigger firms with national or international recognition. This is because they must have a share capital of £50,000 or more to be able to openly trade shares.

Private limited company advantages and disadvantages – explained

As a small business you’ll set up a private limited company if you decide to incorporate. This means you’ll have a separate legal identity and can benefit from a more tax efficient business structure.

While not as big as most public limited companies, there are many benefits to registering as a private limited company:

- private limited companies typically have fewer shareholders – meaning you’re more in control of your business

- private limited companies also face fewer regulatory requirements than public limited companies

- you’ll also have more privacy and confidentiality, as you won’t be required to disclose as much information to the public

However, there are some drawbacks too:

- you may have trouble raising funds, as you’ll have less choice when it comes to investors

- it can also be harder to grow your private company, as you’ll be competing with larger public companies

Ultimately, your choice here will come down to how much control you want in your business, as well as your growth objectives.

Why set up a limited company?

There are a number of advantages of a limited company compared to being a sole trader:

- separate legal identity – this means the company is liable when things go wrong, not you personally. You’ll only lose what you put into the business

- more professional – some businesses might be seen as more professional by others in their industry when they operate as a limited company – it can make it easier to secure suppliers, investment, and eventually sell the business

- tax-efficiency – you pay corporation tax through your business and you can pay yourself in salary and dividends. Depending on your profits, this may be more tax-efficient than setting up as a sole trader

But remember that being a sole trader means a simpler business structure, so it’s important to carefully consider the extra responsibilities involved with limited companies and whether it’s right for your business.

How much does it cost to set up a limited company?

There’s a tangible monetary cost when setting up a limited company, but there are intangible ones too when comparing the structure with sole traders.

- money – it costs £50 to register your private limited company through Companies House online (and more by post), but if you’re new to the process, you may want to hire an accountant or adviser to help with the paperwork

- the day-to-day running of your business – this can cost money too, for example in continued professional advice, or software to keep accurate records

- time – compared to sole traders, there’s more legal responsibilities and administration to keep up with. It’s important to work out whether being a limited company is necessary for the type of business you run

- transparency – information about your limited company, including its directors and earnings, is publicly available online through Companies House

Read more about the difference between a sole trader and a limited company, or watch the video below.

How to set up a limited company online

To register a company online, you just need to visit the UK government website and follow a few short steps. You’ll also be registered for corporation tax at the same time (unless you’ve already done this separately).

You should be registered within 24 hours of completing the online form.

How long does it take to set up a limited company?

It doesn’t take long to register your company with Companies House online. If you’ve got everything ready, you can do it in a matter of minutes and you’re usually registered within 24 hours. Postal applications take eight to 10 days.

But it may take you some time to fill in the paperwork needed beforehand. Having a business plan should help you organise your to-do list and work out how much time you need to get going.

What is the responsibility of a company director?

When you register your business with Companies House, you’ll need to choose a company director. In most cases, the person who registers the limited company will also be the director.

The role of a director in a company is important to understand, as they have legal duties that are unique to the position.

Some of these duties include:

- making sure the accounts are filed on time

- informing Companies House if there’s any change to your company’s registered office

- acting in the company’s best interests

- avoiding any conflict of interest

As the company director, you can hire people to help with these duties but it’ll ultimately fall to you to make sure these get done.

Here’s a full list of company director responsibilities.

Closing a limited company

But what happens if you need to close your limited company? Luckily, it can be as simple as setting up a limited company. The first thing you need to do is make sure you have a company director appointed – if you don’t currently have one, you’ll need to appoint another.

The next steps you take to close your business will depend on a few different circumstances:

Can your company still pay its bills? If so, you can apply to be ‘struck off’ the Companies Register. This is often the easiest and cheapest way to close your business. However, you can also choose to liquidate your business instead.

If your company can’t pay its bills (meaning it’s considered insolvent), you can do either of the two above options – or put your company into administration. With so many options, it’s always best to seek professional advice to find the right fit for your circumstances.

You can find out more about closing a limited company on the government website.

Another option is to let your company become dormant. Your business will be considered dormant if it’s:

- not carrying on business activity

- no longer trading

- not receiving income

If you choose this route, your business will still be registered with Companies House.

To register a private limited company (or not) is up to you

Ultimately, you’ll need to decide if setting up a private limited company is right for you and your business. It depends on the type of work you’re doing, the risks involved, and how much profit you’re making.

So take time to consider the decision carefully and think about the tax implications, possible benefits, as well as additional admin and responsibilities.

Have you set up a private limited company structure for your small business? Let us know your experience in the comments.

Useful small business guides

- What is bookkeeping? A guide for small businesses

- What is Making Tax Digital?

- Guide to Self Assessment tax returns for small businesses and the self-employed

- Is public liability insurance tax deductible?

Photograph: nakophotography/stock.adobe.com

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Photograph: nakophotography/stock.adobe.com