Companies evolve and grow all of the time – and sometimes that means merging with or acquiring another business. You may be looking to expand your business reach and take over more of the market, or hoping to branch out from your current specialism.

No matter which option you choose, it’s important to understand the mergers and acquisitions law and processes to follow. Keep reading our guide to learn how to begin.

What are mergers and acquisitions?

You might hear the terms business merger and business acquisition thrown around in the same sentence – but the two are very different things. If you’re thinking about the future of your company, choosing to merge with or acquire another business will depend on your business goals.

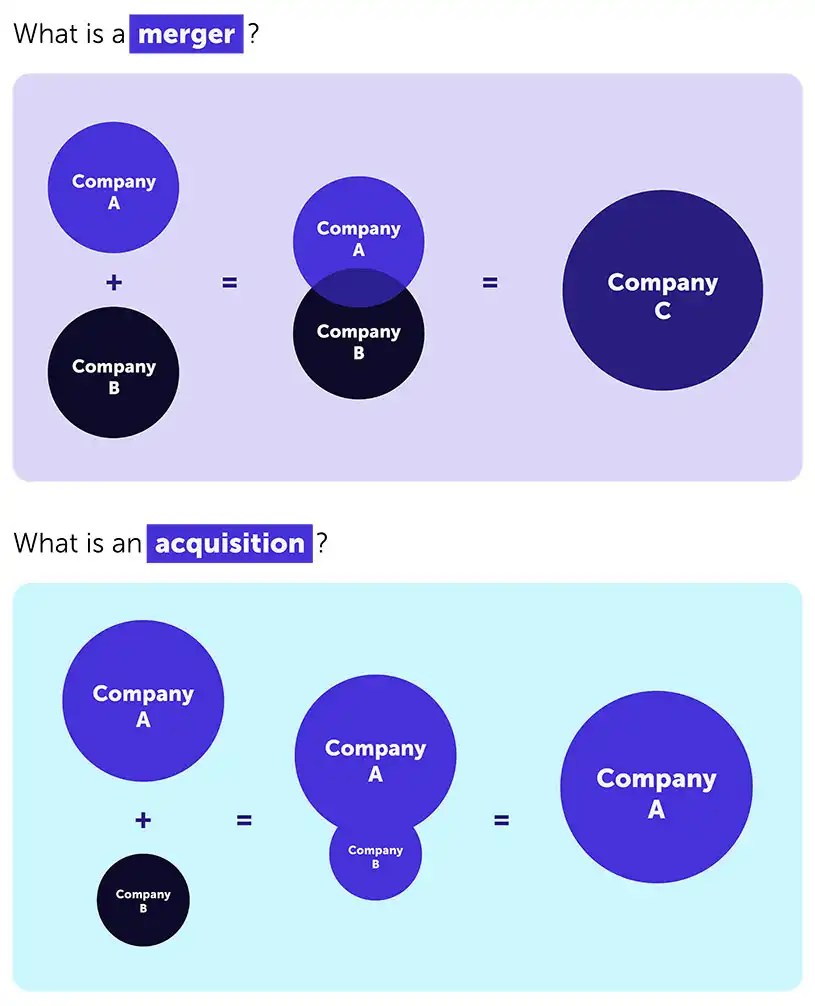

While both terms refer to the joining of two separate companies, there are some key differences.

What is a merger?

A business merger is when two different companies join together to create a new organisation, merging resources and staff. Mergers are less common than acquisitions as there’s usually a very specific business reason for it happening.

Business mergers often happen between two companies of a similar size or scale, who are making a strategic decision to grow their businesses together as one.

Types of mergers

Mergers don’t just come in one form. Depending on your business goals, your merger could be considered:

- a horizontal merger: two similar businesses joining together to expand on their service or product

- a vertical merger: a merger of efficiency, usually when two companies at different points of the supply chain work together

- a conglomerate merger: a complimentary merger, where two differing companies join together to expand their product offering

- a concentric merger: two businesses from the same industry join together to extend their product range

What is an acquisition?

A business acquisition is when one company is taken over, or acquired, by another. This doesn’t create a new company, as the acquired business is absorbed into the purchasing business. This often happens when a larger, more established business acquires a smaller business.

The main difference between mergers and acquisitions is that mergers are generally voluntary moves, whereas acquisitions may not be. This could be due to financial reasons or a change in senior management and often leads to the liquidation of the acquired company.

What are the advantages of mergers and acquisitions?

There are many different advantages to merging with or acquiring another company and each will be specific to your business. When deciding if a merger or acquisition is right for your business, some outcomes to consider are:

- grow your business – mergers and acquisitions bring new economic growth opportunities by reaching new markets and audiences

- access to talent – uniting your company with another gives you access to experienced employees in an already successful and established business

- reducing costs – shared budgets and joint funds means costs may be lower

- less competition – merging with or acquiring your competitors may be cheaper in the long run than continuing to compete against them

Mergers and acquisitions strategy for your small business

Now that you know the difference between a business merger and an acquisition, you might be ready to take the next steps in merging with or acquiring another business. Whether you’re buying a business or selling one, it’s necessary to fully understand the process.

Every business is different, so it’s important to consult with a business or legal professional who knows the exact circumstances surrounding your company. But below we’ve laid out rough guidelines of the steps you may take during a merger or acquisition.

Small business mergers: 9 steps to follow

- Think carefully about the reasons for merging and highlight what you want to achieve

- Choose the company you hope to merge with and begin negotiations

- Find a qualified legal team

- Conduct due diligence checks

- Manage your finances – an accountant may help here

- Agree a merger in principle

- Finalise your negotiations

- Communicate any changes and make plans to integrate the businesses

- Make any external announcements

Small business acquisitions: 8 steps to follow

- Think carefully about whether this is the right strategic move for your business

- Begin negotiations with the company you hope to acquire

- Appoint a legal team

- Look into any funding you need – this could come from investors or even crowdfunding

- Conduct due diligence checks

- Name your price and be prepared to negotiate

- Close the deal

- Make internal and external announcements

Why mergers and acquisitions fail

Of course, sometimes even after all that planning, things don’t work out. Business mergers and acquisitions can be risky – you could end up in a bidding war during a merger or experience tough negotiations during an acquisition.

You could lose key members of staff, fail to meet projected targets, or find your workplace cultures just aren’t compatible. This is why it’s important to do your research and due diligence checks before any contracts are signed.

What happens after a business merger or acquisition?

Once you’ve successfully merged with or acquired another company, you’ll have access to a whole range of new markets and opportunities. Internally, you need to make sure any business changes or strategies have been clearly communicated to staff – particularly after a merger, where the staff of two businesses now work together.

Depending on how public you’ve made your merger or acquisition, there’s different opportunities for your next steps. You can use this as an opportunity to refresh your brand identity or how you market your business. A merger or acquisition can also be a great PR opportunity, furthering your market reach possibilities.

Have you ever thought about merging your business with another? How did it go? Let us know how it went in the comments below.

More guides for small business owners

- Business name ideas – how to do a UK trademark search

- Which bank has the best business bank account?

- What is intellectual property?

- Is business insurance a legal requirement?

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?

Photo: bnenin/stock.adobe.com