The government has published its response to the growing problem of non-compliant umbrella companies. Following a long-running consultation, they’ve revealed plans on how they’ll crack down on umbrella companies who don’t comply when hiring contractors.

The new approach is set to make sure contractors receive the correct tax and employment rights when working through umbrella companies.

What’s changing?

New legislation will define umbrella companies as employment companies, which will be included in an amendment to the Employment Rights Bill. This means that umbrella companies will be regulated by the Employment Agency Standards Inspectorate, resulting in more rights for the contractors working for them.

Further changes include moving the responsibility for PAYE contributions away from the contractor. If a recruitment agency was involved in the supply chain, they’ll be responsible for making sure the correct PAYE contributions are made. If there was no agency involved, the responsibility would fall to the umbrella company.

The changes are set to come into effect from April 2026.

What does this mean for contractors?

These changes will bring much-needed clarity and protections for contractors working through umbrella companies. Some of the benefits include:

- decreased liability: contractors are less likely to be held liable for incorrect tax deductions or unpaid contributions, with responsibility transferred to the umbrella company or recruitment agency

- reduced burden: removing the responsibility for PAYE contributions means that contractors will have less administrative burden and can focus on their work

- increased regulation: umbrella companies will now face greater scrutiny, reducing the risk of exploitation for contractors

- more employment rights: working through an umbrella company will come with increased employment rights for contractors – including holiday pay and sick pay

- increased transparency: contractors will be able to better understand their pay and any deductions made

Overall, these changes mean contractors should enjoy a more secure working environment when working through umbrella companies. Contractors will now be able to get the employee benefits they’re entitled to, while reducing the risk of being exploited by non-compliant companies.

‘Game-changer’ for contractors

Dave Chaplin, CEO of ContractorCalculator, says: “Shifting PAYE responsibility to agencies and end clients is a game-changer, ensuring taxes are properly collected before rogue umbrella companies can rip-off workers and the exchequer with non-compliant practices.

“Regulating umbrella companies will finally bring accountability to an industry that has operated unchecked for too long. The fight against tax fraud and unfair deductions isn’t over, but these reforms lay the foundation for a fairer labour market.”

More guides for contractors

- What is freelance work? How to become a freelancer

- What is an umbrella company? A guide for self-employed contractors

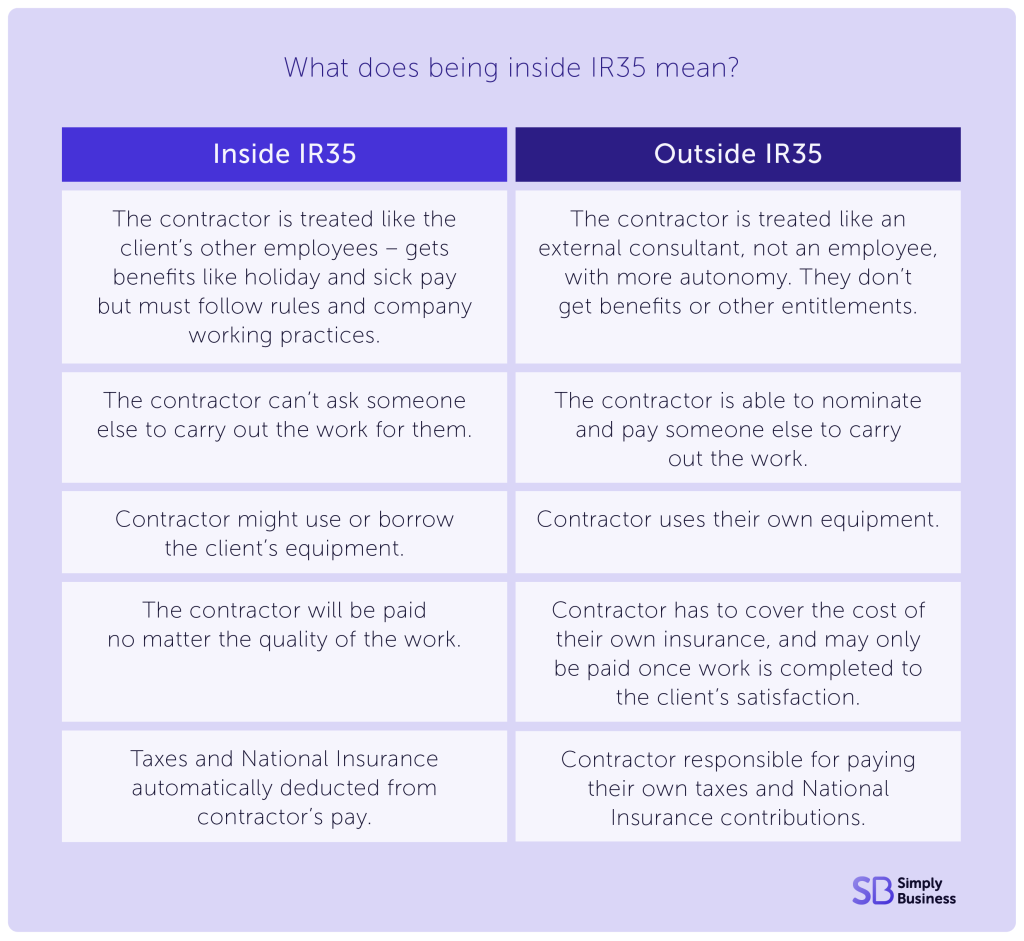

- What does being inside IR35 mean? A guide for the self-employed

- What type of business insurance do I need?