As a landlord, it’s important to keep an eye on average house prices and whether they could go up or down in the future.

If average prices are rising, the future resale value of your property is likely to increase. If they’re falling it may not be a good time to sell, but it could be the right time to buy.

Read on to find out the latest on UK house prices, including:

- are house prices going down or up?

- UK house price predictions for 2024

- UK house price forecast 2024-2029

- what buy-to-let mortgage rates mean for house prices

- what UK house prices mean for landlords

Are house prices going down or up?

Since the global financial crisis in 2008, UK house price growth has been strong and consistent. This is due to demand for homes outstripping supply, which inflates house prices.

From 2020, as a result of the Covid-19 pandemic, average prices increased even quicker as the government introduced a stamp duty holiday and more people looked to relocate.

Following big jumps in average property prices between 2020 and 2022, growth stalled over the next year with price drops recorded in many areas.

This was caused by a combination of economic uncertainty, a cost of living crisis, high interest rates, and rising inflation, which made it harder for people to buy properties.

During 2024 average prices have started to grow again, albeit at a much slower rate than before.

Here’s an overview of average house prices over the last five years from some of the main data providers:

Price index | April 2024 | April 2023 | April 2022 | April 2021 | ||

Halifax | £288,949 | £286,896 | £286,079 | £258,204 | ||

Nationwide | £261,962 | £260,441 | £267,620 | £238,831 | ||

Rightmove | £372,324 | £366,247 | £360,101 | £327,797 |

*Halifax and Nationwide figures are based on purchase prices from approved mortgages. Rightmove figures are based on asking prices for homes for sale

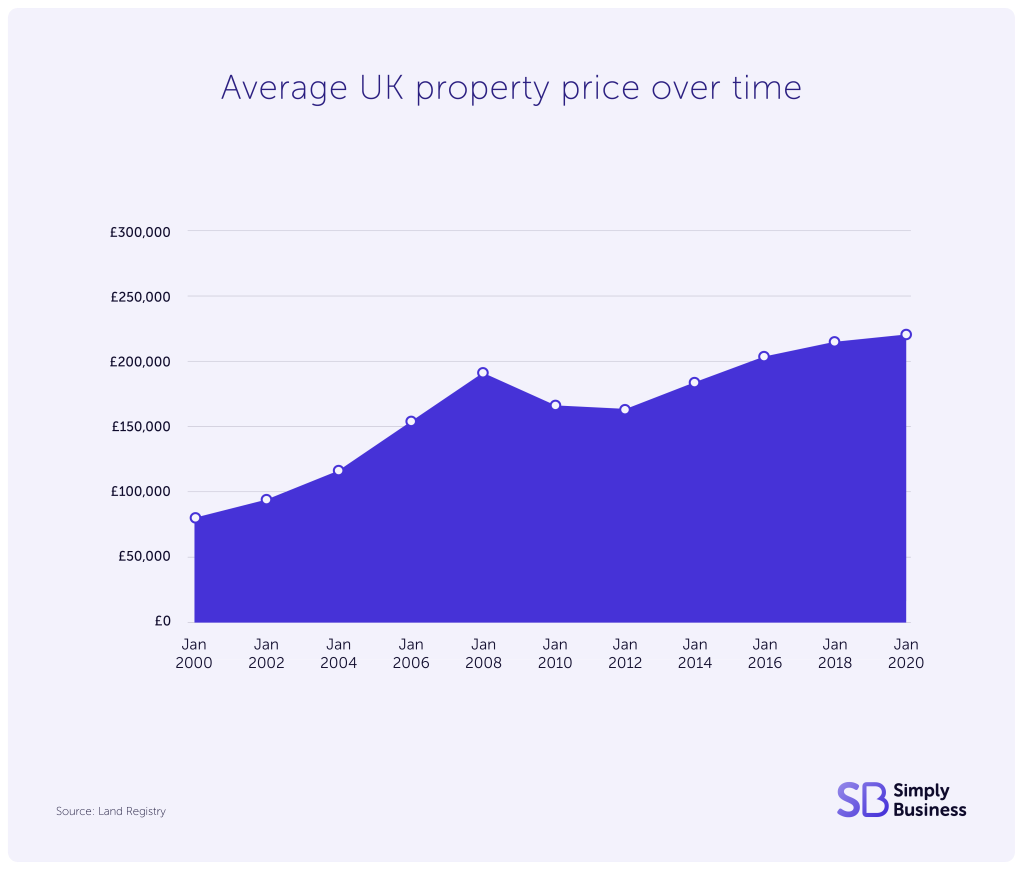

The below graph shows average UK house price growth over the last 20 years, according to the Land Registry.

Between January 2000 and January 2020, the average property price in the UK increased from £84,620 to £231,940 – a £147,320 rise, equivalent to 174 per cent.

UK housing market predictions for 2024

At the start of 2024, the majority of mortgage providers and property experts forecast that house prices would fall or rise slightly this year.

Compared to significant drops forecast in 2023, reasons for these more positive predictions included a stable economic outlook and low unemployment rates. And although interest rates remain high, falling inflation and competition between lenders pushing down average mortgage rates has made room for cautious optimism.

As the year has progressed, there have been predictions for further growth by the end of 2024.

Here’s an overview of some of the 2024 house price predictions from leading market commentators:

Source | 2024 house price prediction |

Lloyds Bank | 2% to 4% fall |

Zoopla | 2% fall |

JLL | 3% fall |

Savills | 3% fall (revised to 2.5% rise, May 2024) |

Knight Frank | 3% rise |

Capital Economics | 5% rise |

These predictions are less severe than those for 2023, which saw experts forecasting average prices to drop by up to 10 per cent. The less drastic drops (and smaller rises) predicted for 2024 show how the property market has recovered after a turbulent period.

Have these predictions come true?

Most market commentators anticipated average house prices to fall this year, with a minority predicting a rise.

Looking at Nationwide’s House Price Index, the average UK property price was up 0.6 per cent year-on-year in April 2024. Meanwhile, Halifax’s data showed a year-on-year rise of 1.1 per cent in April 2024.

If prices continue to increase at the same rate, they could end the year close to Knight Frank’s prediction of three per cent higher than in 2023, potentially falling short of the five per cent rise predicted by Capital Economics.

The current rate of growth suggests that the majority of commentators who forecast house price falls of up to four per cent this year were wide of the mark.

This article is intended as a guide. Always speak to a mortgage professional or property expert if you’re not sure of anything.

House price forecast 2024-2029 – will 2025 be a good year to buy a house?

Average prices dropped between 2022 and 2023, but have started to rise again in 2024. What could happen over the next five years?

The Office for Budget Responsibility (OBR) originally forecast prices to fall by almost five per cent in 2024. However, it has recently revised that forecast to a fall of two per cent.

It then expects house prices to rebound with two per cent growth in 2026 and 3.5 per cent growth in both 2027 and 2028. If these predictions came true, average property prices would surpass their previous peak in the first quarter of 2027.

Meanwhile, Savills has forecast a 3.5 per cent increase in 2025, with further rises of five per cent in 2026, 6.5 per cent in 2027, and five per cent in 2028.

With interest rates having peaked and house price falls for the current cycle seemingly in the past, property price growth over the next five years looks set to return to something more normal following the highs of the post-pandemic boom and the lows of the cost of living crisis.

If you’re looking to buy a property soon, read our comprehensive guide to buy-to-let investment and our article on whether now is a good time to buy a house.

UK property prices can be unpredictable

When looking at future house prices, there are plenty of factors to consider. A growing population could fuel demand for homes, while an ongoing shortage of new properties could restrict supply. This could lead average prices to continue growing.

Property remains a solid long-term investment for many people. And while it may be harder to buy than ever before, the majority of the population have aspirations to own their own home. This is in contrast to some European countries where lifelong renting is the norm.

In recent years it’s been very hard to predict what might happen in the next six months, let alone the next five years.

For example, no one could have predicted how a global pandemic would affect house prices, while the economic instability that caused mortgage rates to increase rapidly was also unexpected.

What is a house price crash?

House price drops and ongoing economic uncertainty over the last two years led to some speculation that there could be a housing market crash.

A house price crash is when average prices drop significantly and suddenly. During a crash, a large proportion of homeowners would have to sell for a lot less than they’d like. A crash, also known as a period of decline or readjustment, usually follows a house price bubble (a sustained period of strong growth).

The most recent house price crash happened in the aftermath of the financial crisis in 2008. The Office for National Statistics estimates that average prices dropped by 15 per cent between 2008 and 2009, with prices not returning to their pre-crisis levels until 2012.

Although average prices did drop consistently during 2023, the fact that they’ve started to grow again means a house price crash was avoided.

Buy-to-let mortgage rates – what do they mean for house prices?

Since 2022, average mortgage rates have fluctuated. There have been several occasions when lenders have withdrawn products from the market, before reinstating them with higher rates.

Almost a third of (31 per cent) landlords saw their mortgage payments increase between 2022 and 2023, according to our Landlord Report. Monthly repayments increased by up to £500 for 19 per cent of landlords, while seven per cent were paying between £500 and £1,000 more each month.

Rising mortgage rates have been driven by high inflation and a higher Bank of England base interest rate, which currently sits at 5.25 per cent.

Although inflation has fallen in recent months (dropping to 3.2 per cent in March 2024 from 11.1 per cent in October 2022), and the BoE base rate has remained steady, average buy-to-let mortgage rates are still higher than in previous years.

For example, data from moneyfactscompare.co.uk shows the average two-year fixed buy-to-let mortgage rate was 5.49 per cent in February 2024. This is significantly higher than the 2.90 per cent recorded in February 2022, but lower than the 6.88 per cent recorded in August 2023.

The rate for five-year fixed buy-to-let mortgages was 5.48 per cent in February 2024. This was up from 3.16 per cent in February 2022, but lower than the 6.72 per cent recorded in August 2023.

If inflation continues to fall and the BoE interest rate remains steady, buy-to-let mortgage interest rates could continue to decrease. However, they’re unlikely to return to the record-low levels seen before 2022.

Lower mortgage rates are likely to encourage house price growth as it means more people can afford to buy, so demand for property is higher.

UK house prices: what do they mean for landlords?

As a landlord, you’ll always be affected by house price fluctuations whether you’re looking to buy, sell, or keep your portfolio the same size.

Our 2023 research found that nine per cent of landlords had sold a property in the last 12 months, with 25 per cent planning to do so in the next 12 months. At the same time, three per cent of landlords said they were planning to buy a property in the next 12 months.

Here are some key points about house prices to consider in relation your rental property:

- if average prices are rising, the value of your property could also rise which could benefit you if you come to sell in the future

- if average prices are falling, the value of your property could also decrease. This means it could be a bad time to sell but a good time to buy

- house prices go in cycles so keeping up to date can help you to make informed decisions when managing your portfolio

- the price you buy a rental property for affects its yield – the higher the rental yield, the better the return on investment

- mortgage rates and house prices are interlinked. High mortgage rates could impact the type of property you might be able to buy, plus how much your monthly repayments would be

What are your house price predictions for the next five years? Let us know in the comments below.

More guides for buy-to-let landlords

- Lettings agency fees for landlords – a guide

- Rental reforms published – what do landlords need to know?

- Buy-to-let tax changes landlords need to know about

- Do landlords need contents insurance?

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.

Victor Moussa/stock.adobe.com