The number of buy-to-let companies has surpassed 400,000 for the first time, according to new research from estate agency Hamptons.

Analysis of Companies House data shows that there are now more companies set up to hold buy-to-let properties than any other type of business.

Read on to find out where buy-to-let companies are most common and why more landlords than ever before are choosing to incorporate.

More than 400,000 buy-to-let companies in the UK

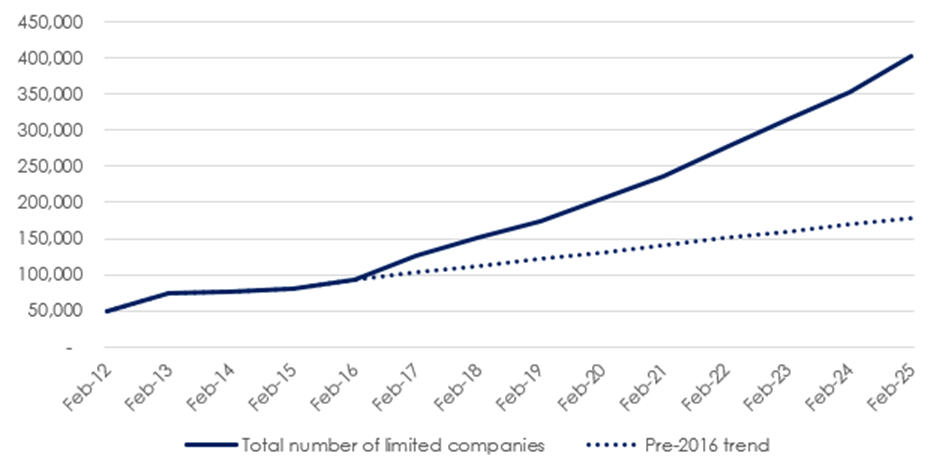

The total number of companies holding buy-to-let properties reached 401,744 during February 2025. In the nine years since Section 24 tax changes were announced, the number of property companies has increased by 332 per cent from 92,975.

Last year was another record for the number of new limited companies being set up by landlords (61,517), surpassing the previous record of 50,004 in 2023.

The 401,744 property companies hold a total of 680,000 rental properties, with the number of properties in ownership rising by between 70,000 and 100,000 each year.

Demand for property companies could fall in 2025

The number of new buy-to-let companies could dip this year due to higher stamp duty costs and lower mortgage rates.

“2024 may prove to be a high watermark for the number of new companies set up to hold buy-to-let property,” said Aneisha Beveridge, Head of Research at Hamptons.

“Higher stamp duty rates will be a big barrier for investors looking to move an existing rental home from a personal name into a company structure.

“It will also weigh down on the number of new buy-to-let purchases overall, likely suppressing the number of companies being set up.”

Read more: Setting up a buy-to-let limited company – a guide for landlords

Majority of landlord purchases go into limited company ownership

Hamptons estimates that as much as 75 per cent of new rental property purchases go into a limited company structure.

Up to four in 10 (40 per cent) of rental properties placed into companies last year were held by companies incorporated in the last 12 months.

That means more than half went into existing companies, 90 per cent of which already held at least one property.

Where are the most BTL property companies in the UK?

London is the UK region with the highest share of buy-to-let companies at 30 per cent. This is likely due to lower average yields in the capital making it even more important for landlords to reduce their tax bill.

The regions with the next highest share are the South East (13 per cent), North West (10 per cent), and East of England (nine per cent).

| Region | Number of BTL companies | Share |

| London | 122,269 | 30% |

| South East | 50,453 | 13% |

| North West | 40,184 | 10% |

| East of England | 36,644 | 9% |

| West Midlands | 31,651 | 8% |

| South West | 24,995 | 6% |

| Yorkshire and the Humber | 24,602 | 6% |

| East Midlands | 24,416 | 6% |

| Scotland | 19,748 | 5% |

| Wales | 11,179 | 3% |

| North East | 9,622 | 2% |

| Northern Ireland | 5,036 | 1% |

| Unknown | 945 | 0% |

| UK Total | 401,744 | 100% |

Why are more landlords setting up limited companies than ever before?

Since 2020, landlords have no longer been able to claim buy-to-let mortgage interest as an expense on their income tax bill. Instead it has been replaced with a 20 per cent tax credit.

This has meant increased tax bills for many landlords, particularly those that pay tax at a higher rate.

As a result, landlords have transferred ownership of their properties to limited companies to pay corporation tax at between 19 per cent and 25 per cent instead of income tax.

More guides for landlords

- New energy efficiency rules for rental properties

- Renters’ Rights Bill – what do landlords need to know?

- Ban on new leasehold flats – how will this affect BTL landlords?

- 5 buy-to-let tax changes for landlords in 2025