Throughout your time as a landlord, you’ll pay various types of tax. As well as paying tax on rental income, you’ll also have to pay tax when you buy and sell a property.

Read our comprehensive guide to UK landlord tax to get to grips with everything you need to know, from completing your annual Self Assessment to paying National Insurance, stamp duty, and capital gains tax.

Use the headings below to navigate to the landlord tax topic you want to learn more about:

UK landlord tax – what do I need to pay?

While you might not think that landlords count as being self-employed, as you’re receiving income that doesn’t get taxed at source (through PAYE), you’ll still need to fill in and submit a Self Assessment tax return to HMRC.

As well as income tax on rental income, there are a few different types of landlord tax to keep in mind:

- National Insurance contributions (NICs)

- stamp duty land tax

- capital gains tax

- council tax

- inheritance tax

Not all of these are paid through Self Assessment. For example, you only need to pay stamp duty land tax and capital gains tax when buying or selling a property.

Tax on rental income – how much do you pay?

You need to complete a landlord tax return by 31 January each year if you make a significant amount of money from renting out a property.

Rental income is taxed at the same rates as other forms of employment:

- zero per cent up to £12,570

- 20 per cent between £12,571 and £50,270

- 40 per cent between £50,271 and £150,000

- 45 per cent above £150,000

It’s important to remember it gets added to any other income you make, which could push you into a higher tax bracket. For example, if you make £15,000 a year from rental income plus £45,000 from a self-employed job, you’ll be taxed on your overall income of £60,000.

This means you’d pay:

- zero per cent on the first £12,570

- 20 per cent on the next £37,700

- 40 per cent on the final £9,730

Paying the right amount of tax can be tricky, so remember to speak to an accountant or professional tax adviser if you’re unsure of anything.

Landlord tax return example

In this example, the landlord receives £1,800 a month in rent from their tenant, leaving them with an annual rental income of £21,600.

Their allowable expenses (including letting agent fees and contents insurance) add up to £3,000, meaning their taxable rental income is £18,600.

The first £12,570 is taxed at zero per cent due to the personal allowance, and the next £6,030 is taxed at 20 per cent.

This leaves a tax bill of £1,206. As the landlord pays £200 a month in buy-to-let mortgage interest, they can claim a 20 per cent tax credit of £480.

This leaves a final bill to HMRC of £726.

If the landlord had other earnings, it would push up their tax bill significantly. Adding a £40,000 annual salary from a self-employed job to the above example would mean the landlord has to pay:

- 20 per cent on £10,270 of rental income = £2,054

- 40 per cent on £8,330 of rental income = £3,332

This would leave them with a final tax bill of £4,906 as their self-employed job pushes them into the higher tax band.

You can use a landlord tax calculator to work out how much your bill could be.

Landlord tax relief – what is the rental income tax allowance?

You get a £1,000 tax-free rental income tax allowance each year, which you can claim on your tax return.

However, a landlord’s rental income will almost certainly be more than £1,000 a year, and you can’t claim any other expenses if you use the property allowance. This means the allowance is only useful if you have less than £1,000 in expenses from renting out your property.

Do landlords pay National Insurance on rental income?

You pay Class 2 National Insurance if renting out properties is your main job and your profits are £6,725 a year or more. Essentially, you only pay National Insurance if you’re running the operation as a business.

When working out whether renting out your property counts as running a business, HMRC says all of the following should apply:

- being a landlord is your main job

- you rent out more than one property

- you’re buying new properties to rent out

If you’re not renting out property as a business, you don’t pay National Insurance – even if you manage your property yourself.

What about corporation tax for landlords?

Some landlords choose to create a limited company for the purposes of letting a property.

That’s because profits are subject to corporation tax at 19 per cent or 25 per cent (depending how much profit you make), rather than higher individual income tax rates – although there are more costs and paperwork involved with running a limited company.

If you’re using the corporate structure, the process is slightly different and you’ll need to set up for corporation tax.

Read more: Record number of landlords open property companies

What happens if you make a loss?

If your annual expenses are higher than your rental income, then you’ll make a loss and won’t be required to pay tax for that year.

The loss will be carried forward to the next tax year and deducted from any future profits.

For example, you made a loss of £2,000 in the 2023-24 year after earning £13,500 in rent with expenses of £15,500.

The following year, you make a profit of £3,500. You would carry forward the £2,000 loss and offset it against your profit. This means you’d only pay tax on £1,500.

Landlord tax if you own multiple properties

If you own several rental properties, you can combine the income and expenses to calculate a total taxable income. This can help to reduce your final tax bill.

It’s important to note that any income for overseas properties or furnished holiday lets should be kept separate.

Landlord Self Assessment tax return – 6 key steps

The Self Assessment process is largely the same whether you’re a landlord, small business owner, or sole trader.

Here are six simple steps to follow:

1. Register for Self Assessment

The first thing you need to do is register for Self Assessment.

You usually need to register by 5 October in the tax year after you begin receiving rental income. So, if you start receiving rental income in the 2024-25 tax year, you’ll need to register by 5 October 2025.

When you register, you should get a Government Gateway user ID and password. With this you can set up your personal tax account, which lets you manage your taxes online.

Once you’re registered, you can then file your tax return by filling out the Self Assessment tax return form either online or on paper.

That being said, Making Tax Digital means that paper tax returns will eventually be phased out. This is due to come in for landlords in April 2026 if you make over £50,000 a year – but you’re able to sign up now if you like.

2. Stay on top of landlord tax deadlines

The deadline for submitting your tax return for each financial year is usually 31 October for paper tax returns and 31 January for online tax returns. So for the 2023-24 tax year, the deadline for paper tax returns was 31 October 2024 and the deadline for online tax returns is 31 January 2025.

Once you’ve filed your tax return, you then need to pay the tax you owe. The deadline is the same as the final date for online Self Assessment tax returns, so the deadline for paying your 2023-24 tax is 31 January 2025.

There are penalties for missing the deadlines, so don’t delay getting yours ready.

3. Gather the right information

To fill in your tax return you’ll need information about all the income you’ve received throughout the tax year, as well as information about expenses you want to deduct.

HMRC says you need to record:

- the dates you let out your property

- all the money you’ve spent (including cash, cheque, credit and debit card transactions)

- all rents received

HMRC lists the documents to keep in support of your records:

- lease or letting contracts

- rent books

- receipts

- invoices

- bank statements

- mileage logs (for journeys that are solely for your property business purposes)

- cost of the vehicle used for property business and its CO2 emissions

- for furnished holiday lettings and commercial premises, the costs of any other capital items used in the property

- all documents relating to when you bought the property

There’s accounting software available that can organise and keep track of your records for you.

You’ll also need your UTR (unique taxpayer reference) number, which is assigned to you when you register for Self Assessment.

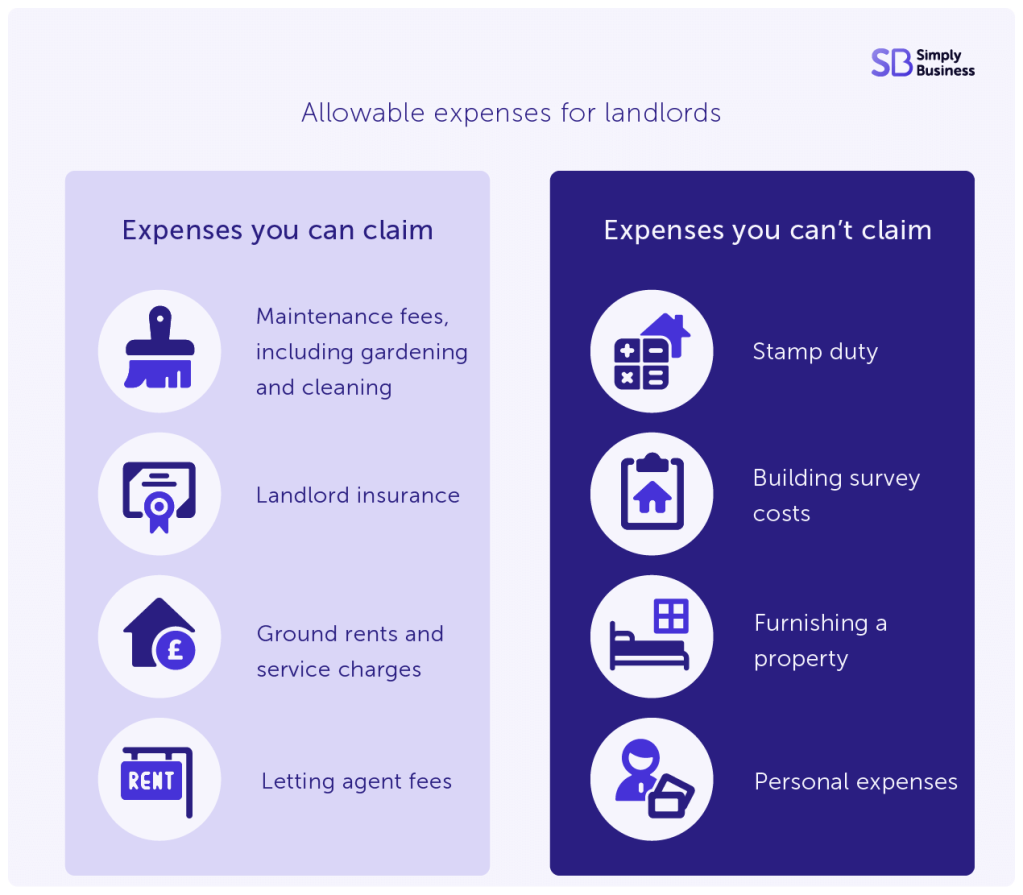

4. Work out allowable expenses for rental income

There are a number of allowable expenses for landlords. You can use these landlord tax deductions to work out your total taxable profit. As a general rule, your expenses need to be ‘wholly and exclusively’ used for the purposes of renting out property.

Some of the main allowable expenses are:

- property repair and maintenance costs (but not improvements)

- accounting and letting agents’ fees

- landlord insurance

There’ve been a number of changes to the way you can deduct mortgage expenses from your rental income. You can no longer claim tax relief on mortgage interest repayments (after being reduced to 20 per cent in 2019-20).

It’s replaced by a 20 per cent tax credit on your mortgage interest repayments.

5. Fill in the landlord tax return

When you fill in your tax return online, HMRC’s system will ask you what type of income you receive, tailoring the return to your circumstances.

UK landlords will need to fill in the UK property section, where you’ll tell HMRC about:

- premiums from leasing UK land

- rental income and other receipts from UK land or property

- income from letting furnished rooms in your own home

- income from furnished holiday lettings in the UK or European Economic Area

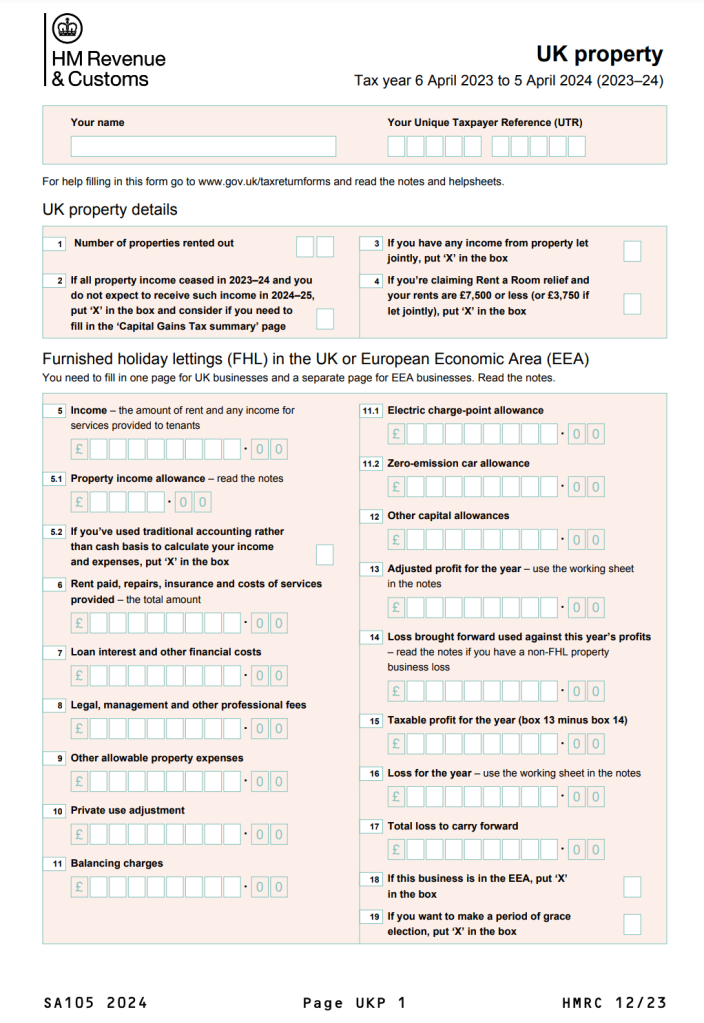

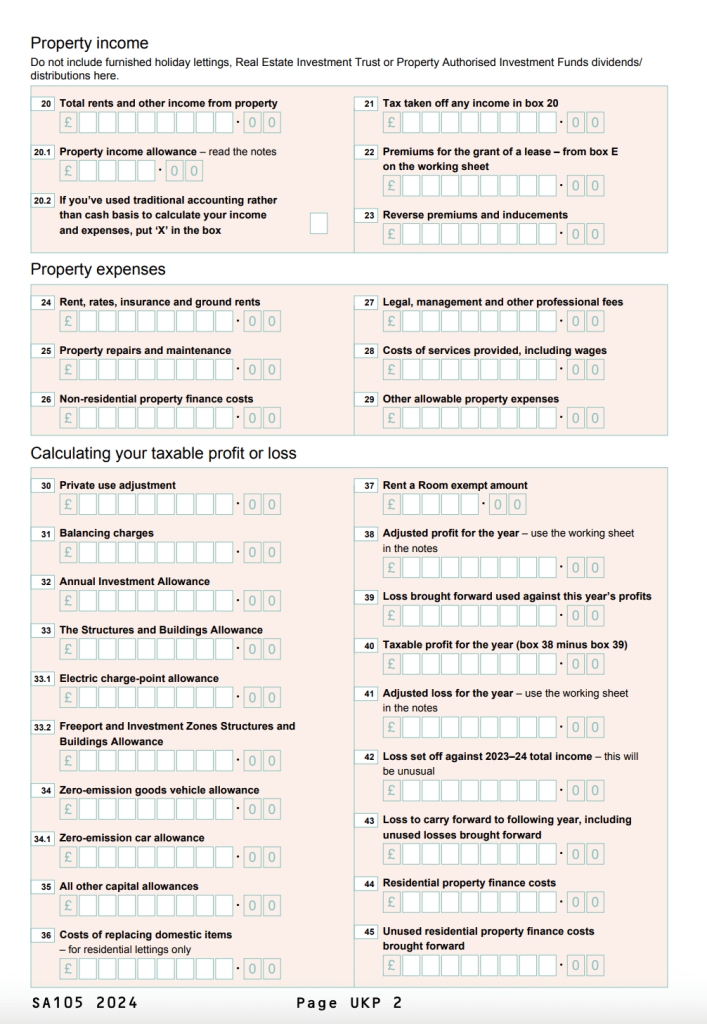

For paper tax returns, everybody needs to fill in form SA100.

Landlords should fill in the UK property supplement SA105 and any other relevant supplements (for example, SA103 if you’re also self-employed).

Pages one and of the SA105 form for filing your landlord tax return. Source: HMRC

6. Pay your landlord tax

HMRC will calculate what you owe and send you a tax bill. If you file online, you can see how much you owe under ‘View your calculation’.

If you send a paper return, you’ll get a bill in the post.

You’ll need your payment reference to pay your bill, which is your Unique Taxpayer Reference (UTR) number followed by the letter ‘K’.

The fastest ways to pay your tax bill are:

- online or telephone banking

- Chaps (Clearing House Automated Payment System)

- debit or corporate credit card online (you can’t pay using a personal credit card)

- at your bank or building society

You can also pay by Bacs, cheque, or Direct Debit, but these take longer.

If your bill is over £1,000, you’ll also need to make a payment on account, which is an advance payment towards your next Self Assessment bill.

If your bill is less than £30,000 for your payment due on 31 January 2025 and you think you’ll struggle to pay, you can use HMRC’s Time to Pay service to set up a payment plan.

Non-resident landlord tax return – what do you need to know?

If you live abroad for more than six months a year, you’ll be considered as a ‘non-resident landlord’ by HMRC.

You can choose to receive your rent in full and then pay tax on it, or you can choose to receive your rent with tax already deducted.

If you receive your rent in full, you’ll need to apply to pay tax through Self Assessment by filling out form NRL1i.

When it comes to doing your overseas landlord tax return, you’ll need to complete the ‘property’ section form SA105 as well as the ‘residence’ section form SA109.

As a non-resident landlord, you won’t be able to use HMRC’s online services to pay your tax return. Instead, you’ll have to send it by post or get help from a professional accountant.

What other taxes do landlords need to pay?

Here’s an overview of some of the other taxes you may need to pay if you rent out property:

- if you rent a room in your main home, you’ll need to pay tax (but there’s a £7,500 allowance available)

- if your property is occupied, you’ll need to pay council tax. Usually the tenants will pay for this themselves, but you may need to cover it if you rent to several people with individual tenancy agreements

- when you buy a second property to rent out, you’ll be required to pay an extra five per cent in stamp duty

- if you decide to sell your rental property, you may need to pay capital gains tax on any profit you make

- if you plan to pass on your rental property to family, you may be liable for inheritance tax which is paid at 40 per cent

Take the time to understand landlord tax

However many properties you own and whatever stage of being a landlord you’re at, the next tax you need to pay is unlikely to be far away.

Understanding the types of tax you need to pay and when, plus what you can do to keep your tax bills down, is a crucial part of being a landlord.

In most cases, working with an accountant or using tax software can help you to stay on top of your finances.

Still unsure about landlord tax and Self Assessment for rental income? Ask any questions in the comments.

Get set with tailored landlord cover

Over 200,000 UK landlord policies, a 9/10 customer rating and claims handled by an award-winning team. Looking to switch or start a new policy? Run a quick landlord insurance quote today.