At Simply Business we’re proud to support hundreds of thousands of incredible women who own flourishing small businesses across the UK.

But that overwhelming sense of pride is paired with frustration. Of the 550,000 small businesses we insure at Simply Business, just 30 per cent are owned by people who identify as a woman.

Almost a million SMEs used our online quote form to research insurance cover for their business in 2022, which gives us privileged insight into the small business landscape. And the average annual turnover for these businesses shows that the gender pay gap is huge – shockingly it’s around £10,000 less for business owners who identify as women.*

We’ve long been passionate about supporting the success of SMEs – that means digging into the challenges they face, shining a light on the key issues, and then playing our part to help.

The worrying lack of women small business owners compelled us to understand what’s holding them back from starting – and growing – their business. What are the challenges they face, and can the government do more to level the playing field?

Report into the challenges faced by women business owners

Sexism and gender inequality remains a widespread issue

After surveying more than 900 women, we found that 81 per cent have experienced sexism, gender inequality, or unequal access to opportunities while running their business.

Sadly, although 81 per cent is a huge number, it felt frustrating to see but not at all surprising. As a woman in business, I’ve experienced sexism first hand many times – at the start of my career when one of my bosses point blank told me he thought women should be in the kitchen, to the familiar reality of my voice as a woman being ignored in meetings.

What’s more, the increasing cost of doing business is a very real challenge and our research shows the impact this is having on women business owners in particular.

One in four women have had to put their business plans on hold due to the cost of living crisis. And only 15 per cent said that their business is at the level they want it to be. Not only is this limiting their own ambitions, but it’s harming recovery and growth of the UK economy.

We’re also hearing that nearly half of women business owners see funding or access to funds as a key challenge, alongside managing health, wellbeing, and family responsibilities.

One in three women surveyed said childcare is one of their biggest challenges. And 28 per cent believe that they aren’t given the same opportunities as men as a result of having children.

This should concern us all

Creating equal access to opportunities for all genders is the right thing to do. But beyond that, gender equality will boost the economy and drive growth.

Small businesses play a vital role in our economy, accounting for over 99 per cent of all businesses, 48 per cent of employment, and more than a third of UK turnover.

Ultimately, the predictions for slow economic growth in the UK paint a worrying picture for our small business community and their ability to innovate, expand, and prosper.

More needs to be done to support women entrepreneurs

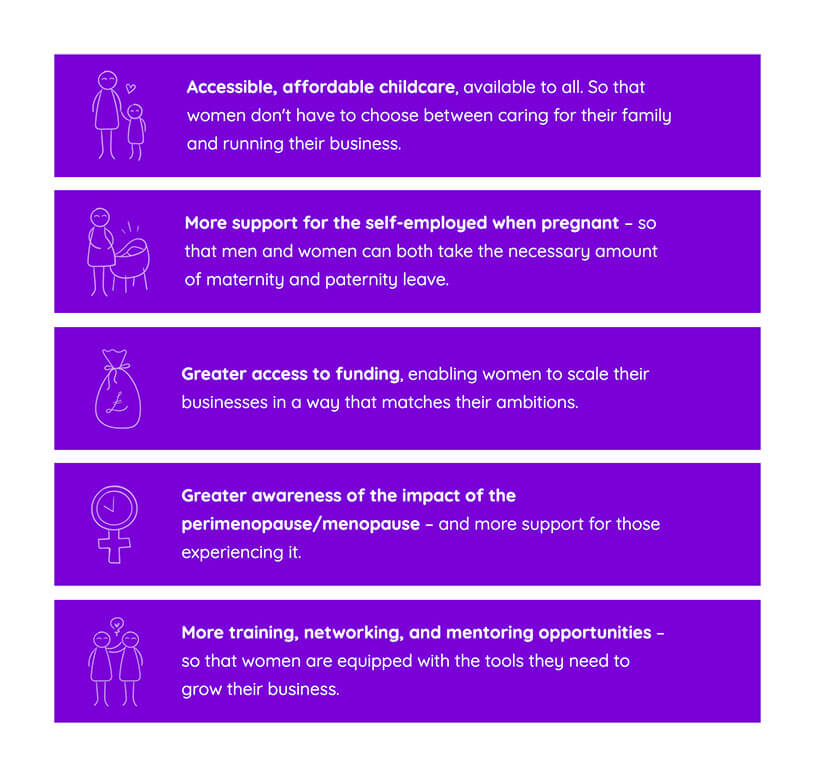

The wants and needs of the 900 women we surveyed came through loud and clear. And our research highlighted five key focus areas that would help create gender equity in business:

- Accessible affordable childcare

- More support for the self-employed when pregnant

- Greater access to funding

- Greater awareness of the impact of the perimenopause/menopause

- More training, networking and mentoring opportunities

We’re pleased that the government has gone some way to address concerns around childcare by increasing the support available for some families. The expansion of free childcare for children under five will give some parents greater flexibility to work on their business after having children.

But a staged approach to introduction means many will have to wait until September 2025 to benefit. Given the challenges small business owners are facing, and in particular women business owners, many won’t be able to afford to keep their businesses open – and the impact of this will be felt not just by our nation’s entrepreneurs but the economy as a whole.

We all have a part to play in driving positive change

I’m proud to work for a business where women make up 66 per cent of the leadership team. In the team, we’ve eradicated common microaggressions like women being ignored. At the same time, our business has enjoyed continued revenue and profit growth and significant customer and employee satisfaction.

But I realise that Simply Business is sadly still a minority. And while our research showed that 92 per cent of women business owners think the government needs to do more to support them, we understand we all have a part to play in driving positive change.

That’s why at Simply Business we’ve re-launched our Empowering Women in Business initiative to highlight the challenges and break down the barriers women entrepreneurs face every day.

Small businesses are so crucial to the UK’s economy and communities, and we’re also hoping to inspire countless creative, resourceful women entrepreneurs across the country to follow their business dreams.

Bea Montoya

Bea Montoya is Chief Operating Officer at Simply Business and is an expert in creating customer-centric marketing efforts, and products and services. She’s proud to be able to work closely with our Marketing, Product and Operations teams to build insurance products that really work for business owners and landlords.

Small business guides and resources

*Based on small businesses who completed our quote form and requested a quote in 2021 and 2022, only taking into account trades with more than 3,000 submitted quotes. The turnover is the average across the quotes submitted

Looking for self-employed insurance?

With Simply Business you can build a single self employed insurance policy combining the covers that are relevant to you. Whether it’s public liability insurance, professional indemnity or whatever else you need, we’ll run you a quick quote online, and let you decide if we’re a good fit.

Photograph: Jacob Lund/stock.adobe.com

Photograph: Jacob Lund/stock.adobe.com