HMRC says if you can pay on time, you should. But if you’re facing financial hardship or personal difficulty, you might be able to pay your tax in instalments.

You can set up a Time to Pay plan by yourself for Self Assessment if you owe less than £30,000 and meet other conditions.

For other types of tax, you’ll need to contact HMRC.

Time to Pay – can you pay HMRC in instalments?

An HMRC Time to Pay arrangement allows you to pay a tax bill in instalments.

If you ignore a deadline, HMRC will charge interest and may hit you with penalties.

Using Time to Pay, HMRC will charge interest but no additional penalties (interest and any outstanding penalties are covered by the arrangement).

The arrangement is based on your financial circumstances, so be prepared to give HMRC this information. You’ll usually need to complete an income and expenditure assessment, which works out how much you can afford to pay and how much time you’ll need to settle your debt.

HMRC won’t typically ask you to pay more than 50 per cent of your disposable income.

Time to Pay is flexible, too. So if you have the money, you can pay more (and reduce your interest). But if your situation worsens, you can lengthen the arrangement.

How do I set up an HMRC payment plan?

You can set up a Self Assessment Time to Pay plan yourself online, if you owe up to £30,000. Make sure you have your:

- tax reference number

- bank account details (this will need to be authorised to set up a Direct Debit)

You’ll also need to give details of any previous payments you’ve missed.

You can spread your payment over 12 months by Direct Debit. You need to:

- have no outstanding tax returns

- have no other tax debts

- have no other HMRC payment plans set up

- set up the Self Assessment payment plan no later than 60 days after the deadline

Interest will be applied to the outstanding amount. You can use the tool by signing in with your Government Gateway user ID and password.

You might still be able to use Time to Pay if you owe more than £30,000 or need more than 12 months, but you’ll need to call the helpline instead.

You’ll also need to call if you owe other non-Self Assessment taxes.

What if I can’t pay my tax bill?

Make sure you get in touch with HMRC as soon as possible.

HMRC Time to Pay is reserved for those in financial difficulty, so if you really can’t pay your bill and have no other options, don’t delay.

What happens if you don’t pay tax?

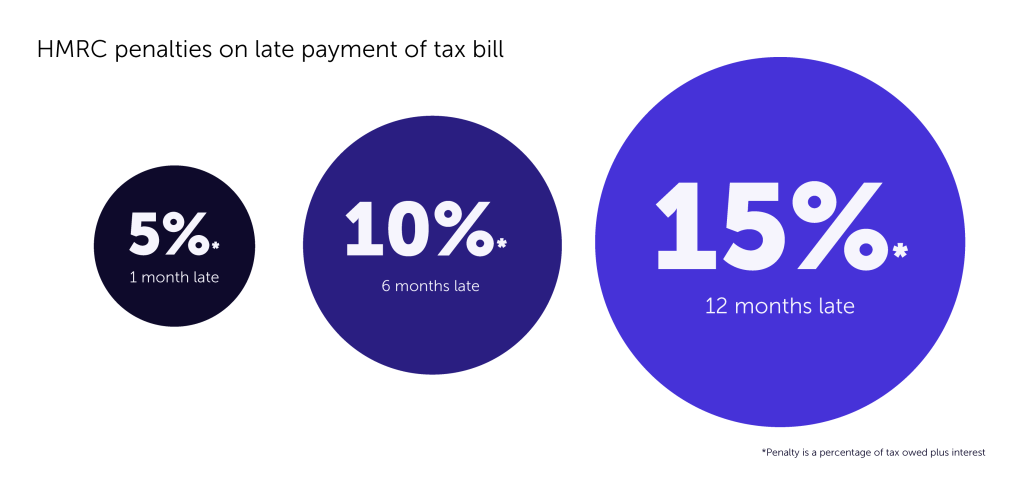

If you don’t pay tax (and don’t set up an HMRC Time to Pay arrangement) you’ll get penalties. Example Self Assessment penalties include:

- if you haven’t paid after 30 days – five per cent of the outstanding tax plus interest

- if you haven’t paid after six months – another five per cent plus interest

- if you haven’t paid after 12 months – again, five per cent plus interest

You can use an HMRC tool to estimate late Self Assessment penalties.

HMRC can also take enforcement action to get the tax owed. The tax authority might take you to court, collect money directly from your bank account, or use debt collection agencies.

Image credit: Simply Business

Read more: HMRC penalties for self assessment

Time to Pay HMRC helpline

If you need to speak to HMRC to set up a plan, you can use the Self Assessment payment helpline.

The number is 0300 200 3820 and it’s open Monday to Friday 8am to 6pm. Ask about Time to Pay.

If you can’t pay a different type of tax, look for contact details on any communication you’ve had from HMRC about the bill. Failing that, call the payment support service on 0300 200 3835.

There’s also a chatbot that’s available 24/7 that can help point you in the right direction.

Can’t afford payment on account?

Payment on account is an advance HMRC tax payment. On 31 January, you pay any remaining tax for the previous tax year, as well as half of your estimated tax bill for the current tax year.

If someone is already in financial hardship, making a payment on account can make the situation worse. It also catches newly self-employed people out, who are often faced with a tax bill that’s much larger than expected.

It’s useful to complete your tax return as early as possible, so you know how much tax you need to pay, including your payment on account.

But if you can’t afford payment on account and you set up an HMRC Time to Pay arrangement, you’ll pay your bill in instalments.

Keep in mind that you can also apply to reduce payment on account if you think your income will be lower next year. But if you reduce it so much that you underpay tax, HMRC will charge you interest and penalties.

More Self Assessment tax return tips for the self-employed

- When is the Self Assessment deadline?

- Get prepared for Self Assessment

- What are allowable expenses for my business?

- Why do I need business insurance?

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?