If you’re self-employed or run a small business, you’ll probably need to complete a Self Assessment tax return each year.

It might sound daunting, but once you understand what’s involved – and when to do it – the process is straightforward.

In this guide, we’ll explain what a Self Assessment is, who needs to file one, and walk you through each step of completing and submitting your return.

Get your free guide on completing your tax return

Download your free in-depth guide to completing your self-employed tax return. Why not save it and refer back to the guide when filling in your Self Assessment?

What is a Self Assessment tax return?

Self Assessment is HMRC’s system for collecting income tax from people whose income isn’t automatically taxed at source – for example, the self-employed, company directors, or landlords.

Instead of your tax being deducted through PAYE, you’re responsible for reporting your income, expenses, and any other taxable earnings to HMRC once a year.

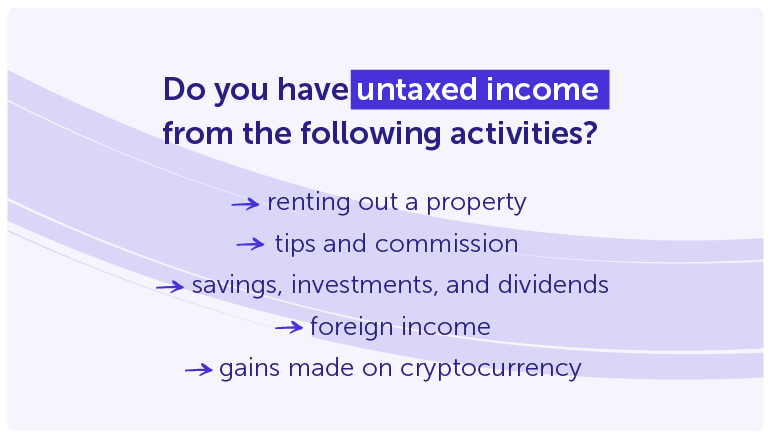

You’ll also need to complete a tax return if you have significant income from savings, investments, and dividends.

Who needs to file a Self Assessment?

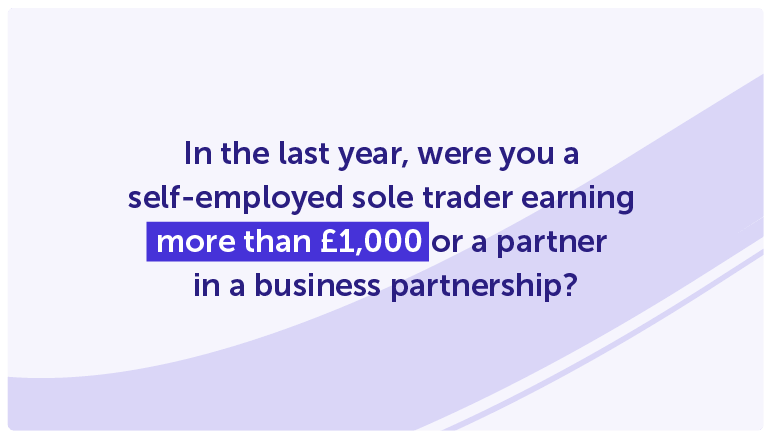

You’ll usually need to complete a Self Assessment if you:

- earned more than £1,000 as a sole trader in the last tax year

- are a partner in a business partnership (by filling in a SA800 Partnership Tax Return form)

- receive rental income from property

- own a limited company and pay yourself salary and dividends

- have other untaxed income (for example, from investments, tips, or foreign income)

You can check if you need to file by using HMRC’s online tool.

Key tax dates and deadlines

The UK tax year runs from 6 April to 5 April the following year.

For most people, the online Self Assessment deadlines are:

| Task | Deadline |

| Register for Self Assessment | 5 October (after the end of the tax year you need to file for) |

| File your tax return online | 31 January |

| Pay any tax owed | 31 January |

From April 2026, Making Tax Digital (MTD) will be phased in, meaning everyone will need to file their tax return online. This will also introduce quarterly updates, including an end-of-year declaration, instead of one annual Self Assessment. Find out more in our full guide.

Can you submit your tax return early?

Yes – you can file your tax return as soon as the tax year ends on 5 April.

Filing early means you can:

- find out what you owe sooner

- spread or plan your payments

- avoid last-minute stress (and potential late-filing penalties)

- receive a tax refund earlier if you’ve overpaid

Early submission doesn’t mean you have to pay straight away – payment is still due by 31 January.

Before you start: what you’ll need

Having everything ready before you begin makes the process smoother. You’ll need:

- your unique taxpayer reference (UTR)

- your Government Gateway ID and password

- records of income and expenses

- any P60s, P45s, or pension statements

- bank interest statements and dividend details

What is a UTR number?

Your unique taxpayer reference (UTR) is a 10-digit number HMRC uses to identify you.

You’ll need it to file your return, register for Self Assessment, or contact HMRC about your tax.

You can find it on:

- previous tax returns or HMRC letters

- your online HMRC account

- the HMRC app (more on this below)

If you’ve never filed a return before, you’ll get your UTR after registering for Self Assessment – allow up to 10 days to receive it by post.

Example: when to file my online Self Assessment

If you’re self-employed and earned a gross income of £100,000 in 2024-25, for example, you’d need to complete your tax return for that year’s earnings by January 31 2026.

Based on the £100,000 income, and claimed back £8,000 in business expenses, your tax liability for the 2024-25 tax year would look something like this:

- income tax: £24,232

- class 4 National Insurance: £3,097

- total tax owed: £35,329

What if I don’t file a Self Assessment?

If you don’t file your Self Assessment (and you earned over £1,000 in gross income), you could face a variety of penalties:

- late filing penalty – if you miss the deadline, you’ll receive an automatic £100 penalty

- daily penalties – if your return is still not filed three months after the deadline, you’ll be charged £10 per day, up to a maximum of £900

- fixed penalties – after six months, you’ll receive a fixed penalty of £300 or five per cent of the tax due, whichever is bigger. This penalty is also applied after 12 months

- late payment penalties – there are also penalties if you don’t pay your tax bill on time

If the debt isn’t paid after this, HMRC could escalate to debt collection, court action, and even business closure.

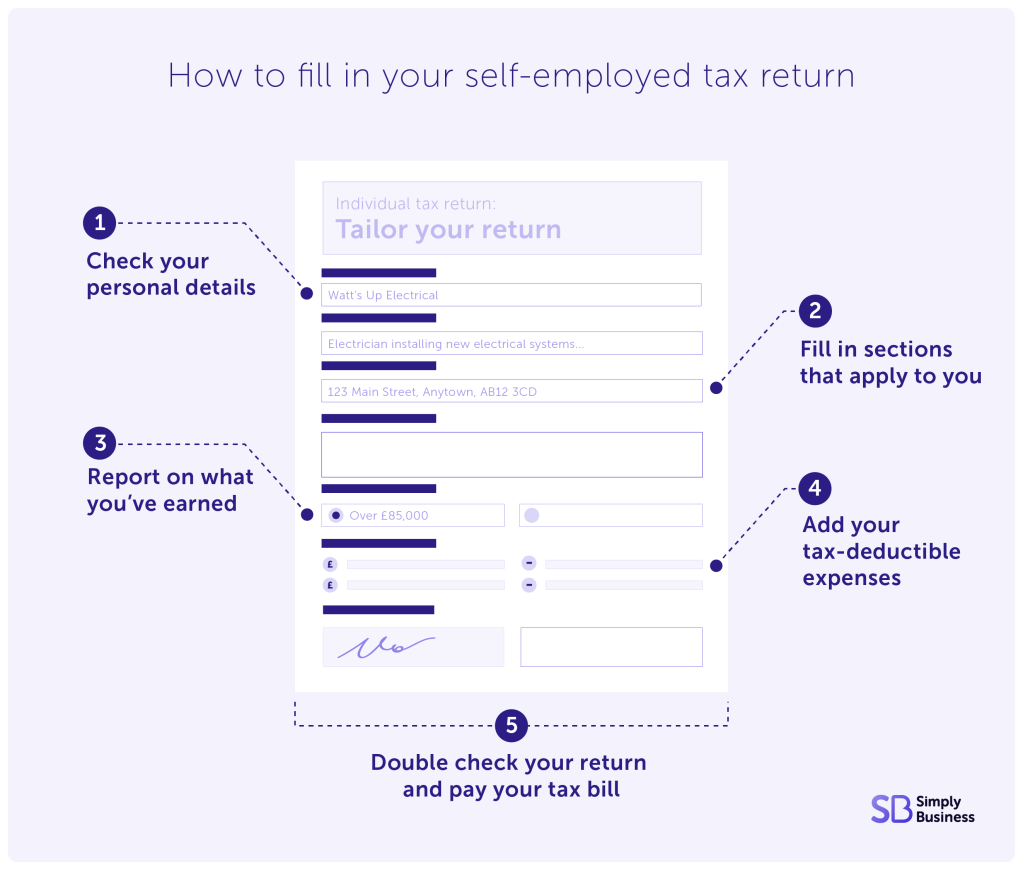

How to do a Self Assessment tax return (step by step)

Follow these simple steps to complete your Self Assessment online.

Step 1: Register with HMRC

If this is your first time, you need to register for Self Assessment and Class 2 National Insurance. You can do this through your HMRC online account.

Make sure to register by 5 October in your business’s second tax year. Once registered, HMRC will post your UTR to you.

Step 2: Gather your records

Collect all your business and personal income details, along with allowable expenses.

For self-employed Self Assessment, the key information is likely to be your income and expenditure details, so you should have all your invoices and receipts to hand.

Remember that there are allowable expenses you can subtract from your turnover when submitting your tax return.

It’s important to keep good records throughout the year. Not only does this make filling in your return easier, HMRC may check your return after you’ve filed and ask to see your records. You’re required to keep your records for five years after the 31 January deadline.

After MTD becomes mandatory from April 2026, you’ll be required to keep digital records of what goes into your tax return.

Step 3: Log in and start your return

You can file through the HMRC website. Here are some things to keep in mind:

- check your personal details – HMRC should be kept up to date with changes to your address or name, so make sure you use this time to check they’re correct

- the system reacts to your details as you enter them – so as you fill in the Self Assessment form, it may remove sections that aren’t relevant to you

Step 4: Fill in your income and expenses

Enter details of your self-employed income, business costs, and any other income (like rental or investment income).

HMRC will automatically calculate your tax and National Insurance contributions.

Remember: add your tax-deductible expenses

Use your expense receipts when filling in this section. Our guide to what you can claim as self-employed tax deductible expenses has more details.You can also use simplified expenses (based on a flat rate) if you have relatively few business expenses.

Step 5: Review and submit

Double-check all figures before hitting submit. Once filed, HMRC will confirm receipt and show how much you owe (or are owed).

You can still make an amendment even if you notice a mistake after you’ve submitted your Self Assessment. Read up on how to amend errors and mistakes with HMRC.

Step 6: Pay your tax bill

Payment is due by 31 January. You can pay via:

- bank transfer or debit card

- Direct Debit

- the HMRC app

When you submit your tax return, you should get a confirmation message and a reference number. HMRC will calculate the tax you owe, as well as the National Insurance contributions you need to pay.

How to use the HMRC app for your Self Assessment

The HMRC app can help you:

- check your UTR number and tax code

- see what you owe

- make payments quickly and securely

- access messages and updates from HMRC

It’s especially useful for keeping track of deadlines and viewing your tax history in one place.

To download:

- visit the App Store or Google Play

- search “HMRC”

- log in using your Government Gateway details

Contact HMRC if you need any help

If you need some assistance with your online tax return, you can get in touch with HMRC in a few different ways depending on what you need:

- income tax helpline – 0300 200 3300

- Self Assessment helpline – 0300 200 3310

- National Insurance helpline – 0300 200 3500

- HMRC digital assistant – talk to HMRC’s chatbot online

- webchat – HMRC offers webchat support for some issues

Common mistakes to avoid

Avoid these frequent errors to keep things simple and penalty-free:

- missing the filing deadline – fines start from £100 even if you don’t owe tax

- forgetting to report all income sources (e.g. side jobs or property)

- not claiming allowable expenses – you could be paying more tax than necessary

- using the wrong figures – double-check totals from invoices and bank statements

- not keeping digital records – HMRC is moving towards Making Tax Digital

What if I miss the deadline for submitting my Self Assessment?

The deadline for paying your tax return is the same day as the deadline for filing – 31 January.

If you file your tax return late, you’ll get a £100 penalty (if it’s up to three months late – the fine is more if it’s later). After that, HMRC uses a points-based system to apply penalties.

Read more about penalties for missing the tax deadline as well as proposed changes to the penalty points system.

What is a tax return?

Self Assessment is the overall system HMRC uses to collect income tax, while a tax return (also known as form SA100) is the specific form you fill out and submit as part of your Self Assessment.

Your tax return tells HMRC how much income you’ve received during the tax year. This is then used to work out how much tax you need to pay.

HMRC tax return guidance

There’s lots of Self Assessment guidance on the government website and you can also call the Self Assessment helpline on 0300 200 3310.

But in previous years HMRC’s phone lines have crashed, so make sure you leave enough time to get in touch with them if you need to.

HMRC also warns the self-employed to watch out for tax scams during Self Assessment.

Using an accountant to help with tax returns online

Using an accountant can make filing your Self Assessment simpler. While it’s still your responsibility to gather the correct information, an accountant can help you:

- understand what information you need for your tax return

- analyse what tax allowances you’re entitled to

- follow the latest tax regulations

- communicate your issues with HMRC

- organise your finances for future tax returns and make sure you’re working tax efficiently

Help if you’re struggling to pay Self Assessment tax

HMRC’s Time to Pay service is available if you can’t pay your tax bill by the 31 January deadline.

This is for those struggling financially – so if you can pay your tax bill, you should, not least because through Time to Pay you’ll pay interest on what you owe. This makes your bill more expensive.

You’ll need to complete your tax return first, so don’t leave it until the last minute. If you miss the deadline for either filing your return or paying your bill, HMRC may give you a fine.

You can call the HMRC Self Assessment payment helpline on 0300 200 3820 to discuss a Time to Pay plan.

Self Assessment – final checklist

Before you submit your Self Assessment, make sure you’ve:

- registered for Self Assessment (if new)

- found your UTR and login details

- gathered your income and expense records

- checked deadlines and amounts owed

- submitted and paid before 31 January

FAQ: common questions on tax returns

When can I submit my Self Assessment tax return?

You can file the day after the tax year ends (6 April) and anytime up to 31 January.

What happens if I miss the deadline?

HMRC will issue an automatic £100 fine for late filing, plus additional daily penalties after three months.

Can I get a refund if I overpay my tax?

Yes, you can get a refund if you overpay your tax. HMRC will calculate your tax liability and send you a refund if you’ve overpaid.

What happens if I stop being self-employed?

It’s crucial that you tell HMRC if you stop being self-employed, don’t assume they’ll know just because you’ve stopped trading. And you’ll need to complete a final tax return for the year that you stopped being self-employed.

Can I file a tax return for previous years if I have forgotten?

You can file a tax return for previous years but you might be fined by HMRC for late filing. And if you’re filing over four years late, you’ll lose your chance to get a refund if you overpay tax.

Can I claim tax relief on working from home?

If you run your business from home, you can claim back some of your home expenses as business expenses. You’ll just need to determine the proportion of your home that’s used for business purposes.

This can be based on the number of rooms used exclusively for work or the percentage of your home’s square footage dedicated to your workspace.

How can I get my tax refund online?

You can claim a tax refund online through the government gateway or on the HMRC app. It usually takes a couple of weeks for them to process your tax return and see if you’ve overpaid.

Is there a deadline for tax returns in the UK?

Yes, there’s a deadline for tax returns in the UK. If you submit a paper Self Assessment, the deadline is 31 October, and 31 January for online submissions.

Can I do my own tax return without an accountant?

Yes, you can do your Self Assessment without an accountant. There’s no legal requirement to use an accountant, they can just make the process simpler if you’re unfamiliar with the Self Assessment process.

How do I download my HMRC tax return?

You can download your tax return through your personal tax account on the government website. Just click on the Self Assessment section, select the tax return you want, and download a PDF from there.

How much is Self Assessment?

The amount of tax you owe each year depends on how much you earn. Read our guide to self-employed tax rates and bands to see how much you might need to pay.

You can also use the government’s Self Assessment tax calculator to get an estimate of how much you’ll need to pay HMRC.

Ready to set up your cover?

As one of the UK’s biggest business insurance providers, we specialise in public liability insurance and protect more trades than anybody else. Why not take a look now and build a quick, tailored quote?